Understanding the Cash Flow Statement in QuickBooks

You are probably familiar with income statements and balance sheets, but what about the cash flow statement? While the income statement shows a company’s revenues, expenses, and profitability over a period of time, and a balance sheet reports the assets, liabilities, and capital of a business at one point in time, the cash flow statement acts as a bridge between the two. It shows how money has moved in and out of the company and offers valuable information about its liquidity. We will explore the cash flow statement, how to generate it in QuickBooks Online, and how to interpret its components.

How to Generate the Cash Flow Statement in QuickBooks Online

Generating the cash flow statement in QuickBooks Online is a straightforward process. Follow these step-by-step instructions to create the report:

- Log in to your QuickBooks Online account.

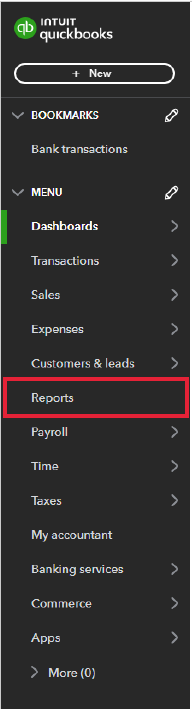

- Navigate to the "Reports" tab in the left menu bar.

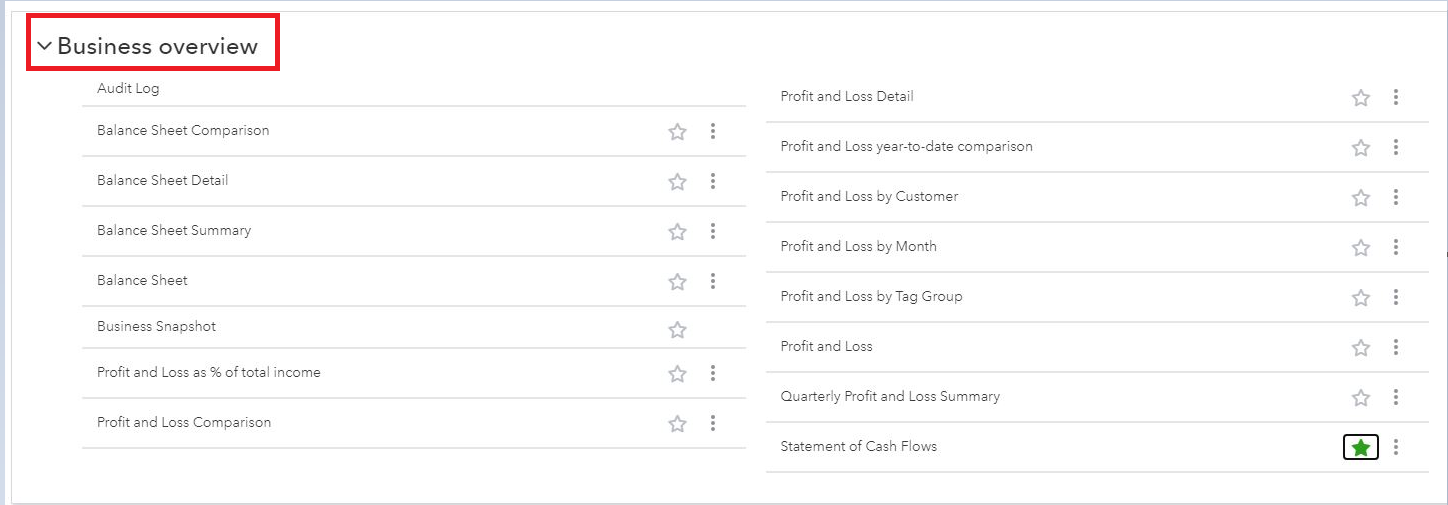

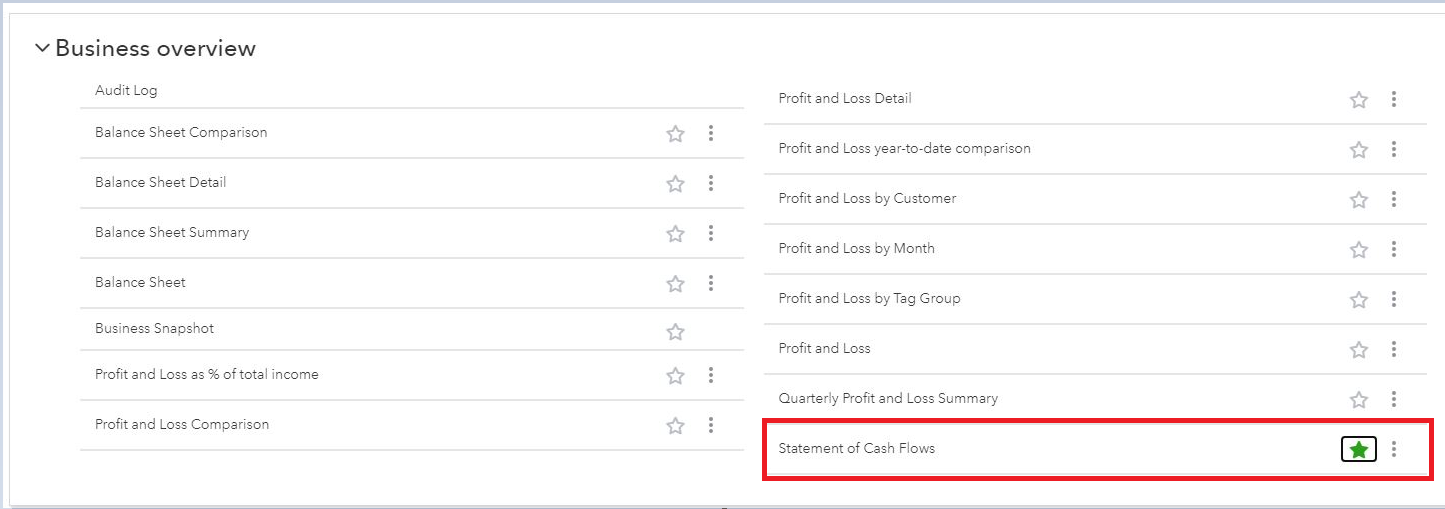

- Click on the "Business Overview" section.

- Look for the "Statement of Cash Flows" report and click on it.

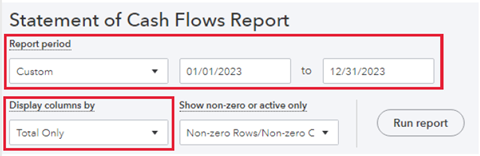

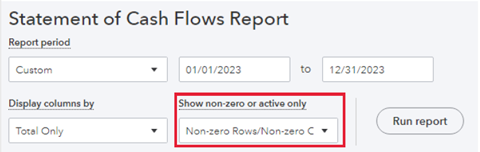

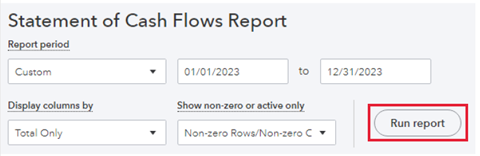

- Adjust the basic options for your report, such as the reporting period and display columns.

- Select the accounts you want to include in the report by choosing the appropriate options in the "Show nonzero or active only" section.

- Click the "Run Report" button.

Components of the Cash Flow Statement

The statement provides an inclusive view of a company's cash position by categorizing cash flows into three main sections: operating activities, investing activities, and financing activities.

Operating Activities

The operating activities section reflects the cash flows resulting from a company's core business operations. It includes cash received from customers, payments made to employees and suppliers, and other cash transactions directly related to generating revenue. You'll find specific components such as:

- Cash received from the sale of goods or services

- Cash paid to suppliers for inventory or raw materials

- Cash paid to employees for salaries & wages

- Cash paid for interest & taxes

- Changes in working capital, such as accounts receivable & payable

Investing Activities

The investing activities section focuses on cash flows related to acquiring and disposing of long-term assets. It includes cash inflows and outflows from activities such as purchasing or selling property, plant, and equipment, as well as loans made to other entities. Investing activities indicate the capital expenditure and investment decisions of a company. Key components in this section include:

- Cash received from the sale of assets

- Cash paid to purchase property, plant, and equipment

- Cash paid for loans made to other entities

- Cash received from the sale of investments

Financing Activities

The financing activities section highlights cash flows related to a company's financing structure. It includes activities such as issuing or repurchasing equity shares, obtaining or repaying loans, and paying dividends to shareholders. Financing activities reflect the company's capital structure and ability to raise funds. Important components in this section include:

- Cash received from the issuance of shares or loans

- Cash paid to repurchase shares or repay loans

- Cash paid as dividends to shareholders

- Reconciling the cash flow statement

Reconciling the cash flow statement involves ensuring that the cash reported aligns with the corresponding transactions recorded in the accounting system. This reconciliation process helps to identify any discrepancies or errors that may have occurred during data entry or recording.

To reconcile the cash flow statement, follow these steps:

- Compare the cash flow statement with the corresponding general ledger accounts in QuickBooks.

- Verify that the cash inflows and outflows reported in the statement match the transactions recorded in the system.

- Investigate any discrepancies and make necessary adjustments to ensure accurate reporting.

- Re-run the cash flow statement after reconciling to ensure the corrected data is reflected accurately.

By regularly reconciling the cash flow statement, you can ensure the accuracy of your financial reporting and make informed business decisions based on reliable information.

Interpreting the Cash Flow Statement

Interpreting the cash flow statement is essential for gaining insights into a company's financial health. Here are some key points to consider when analyzing the cash flow statement:

Operating Cash Flow

The operating cash flow shows the ability of a company to generate cash from its business operations. A positive operating cash flow is generally considered a healthy sign, as it demonstrates that the business is generating sufficient cash to cover its day-to-day expenses.

Investing Cash Flow

The investing cash flow reflects the company's capital expenditure and investment decisions. Positive cash flows in this section may indicate growth and expansion, while negative cash flows may suggest divestment or strategic investments.

Financing Cash Flow

The financing cash flow provides insights into how a company is funded and its capital structure. Positive cash flows in this section may indicate successful fundraising activities, while negative cash flows may indicate debt repayment or stock repurchases.

Cash Flow vs. Profit

It is important to differentiate between cash flow and profit. While profit is a measure of revenue minus expenses, cash flow focuses on the actual movement of cash. A company can be profitable but struggle with cash flow issues if there are delays in receiving payments or high levels of inventory.

Trends and Ratios

Analyzing trends in the cash flow statement over time can be a great window into a company's financial performance. Calculating cash flow ratios, such as the operating cash flow ratio or cash flow margin, can help assess the company's liquidity and efficiency.

By understanding and interpreting the cash flow statement, business owners and financial professionals can make informed decisions regarding their company's financial health, investment opportunities, and cash management strategies. By understanding the components of the cash flow statement and reconciling it regularly, businesses can gain a comprehensive view of their cash position and ensure financial stability and growth. If you have questions or want to learn more about our Client Advisory Services, please contact us.

Recent News & Insights

Do You Need a Family Office? 7 Aspects to Consider

Tariff Volatility + 4.7.25

Lutz Named Top Consulting Firm in 2025 Omaha B2B Awards

Direct vs. Indirect Costs in the Construction Industry

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)