Smart Legacy Building: Effective Tax-Saving Strategies for Your Estate

In the previous segment of our Estate Planning Series, we discussed the 2026 sunsetting of estate tax exemptions. This change is most impactful for anyone with a net worth above the estimated sunset limit of approximately $7 million per person or $14 million per married couple. However, that doesn’t mean anyone with an estate less than those amounts doesn’t have concerns about the future estate tax exemption.

What if I (we) don’t feel comfortable gifting away a large portion of our net worth to maximize current estate exemptions? Various estate planning strategies can be considered, and all should be well thought out before rushing into any of them. This blog examines three tax-efficient solutions.

1. Spousal Lifetime Access Trust (SLAT)

One solution includes making a gift that the grantor still has indirect access to. An irrevocable trust that accomplishes this that we commonly see used is a Spousal Lifetime Access Trust (SLAT).

How does a SLAT work?

Spouse A makes a gift to an irrevocable trust that Spouse B is the beneficiary of (would also have secondary beneficiaries listed, such as children). Since Spouse B can pull funds for their own benefit, this provides indirect access to the funds for Spouse A should the funds be needed.

The goal in using this strategy is ultimately not to pull the funds out using the indirect access, as this would undo the estate tax benefit that was trying to be captured. However, accessing the funds when they are needed helps provide some peace of mind.

The potential downside to a SLAT is you could lose indirect access at some point in the future. This would result from Spouse B predeceasing Spouse A or the couple’s divorce. In the divorce scenario, Spouse B’s interest could be terminated, but the indirect access for Spouse A would also be lost.

Gifting

Another important factor to consider is the future potential growth of gifted assets. Making a gift today that removes assets from your estate allows for future growth of those assets outside of your taxable estate. For this reason, it may still make sense to make a gift even if it is not over the estimated sunset exemption level.

This can be especially true for highly appreciable assets. If there are assets that you are not planning to rely on for retirement goals, they make an ideal candidate for gifting. Other examples may be a family business or farm intended to be passed to the next generation. Entities such as LLCs can be used and potentially receive a discounted valuation when making gifts if properly structured.

2. Grantor Retained Annuity Trust (GRAT)

In the conversation of future growth, we should also discuss a Grantor Trust strategy that is commonly used – Grantor Retained Annuity Trust (GRAT). In basic terms, this trust is an annuity back to yourself, but the growth of assets funding it that is captured inside the trust by the end of the GRAT term stays outside your taxable estate.

How does a GRAT work?

You are required to pay an interest rate to yourself (Section 7520 Interest Rate), so again, the best assets to use in a GRAT are those with the most appreciation potential. If the assets do not grow above the interest rate required during the term, then the entire balance comes back into your estate, and you’re out the legal costs to set up these structures. Since this is a loan back to yourself, this does not use any of a person’s estate exemption amount, making it enticing to people who aren’t quite ready to irrevocably gift away assets (or those who have already fully utilized their estate exemption).

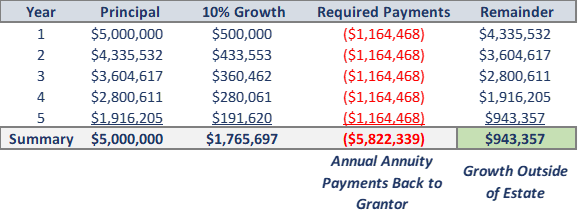

Below is an example of a 5-year GRAT using the September 2023 Section 7520 Interest Rate (5.3%) and a highly appreciable asset valued at $5 million and a 10% assumed growth rate:

Gifting

Since this is a grantor trust, the trust owner can choose to continue paying the taxes generated by the assets that are now outside of their estate. This is the equivalent of an additional “gift” as the trust will grow without tax drag that would otherwise be associated with a taxable account (i.e., dividends, interest, capital gains). However, paying the tax bill is not considered a gift for exemption or annual gift exclusion purposes.

Another item to note regarding taxes is that the grantor has a one-time option to change the taxes from being paid personally to being paid out of the trust. Once this is triggered, it can’t be undone. However, it may get to a point where the individual feels the trust is large enough to accomplish their estate planning goals, or taxes may get to a point where they are causing concern to the grantor’s financial picture.

3. Other Common Estate Reduction Strategies

Additional methods can be used to remove assets from your taxable estate without making a large irrevocable gift.

Annual Gift Exclusion

Everyone can use the Annual Gift Exclusion, which is currently $18,000 per person to any individual (spouses each have their own exclusion, effectively doubling this amount to any individual). This can add up quickly if someone is really trying to minimize their estate.

529 Education Savings Plan

Contributing to a 529 Education Savings Plan is another way to lower your taxable estate, allowing the 529 owner to maintain control of the asset (this would count toward the annual exclusion amount).

While this is not an exhaustive list, it is intended to show additional ways that someone could lower their taxable estate without making a large gift.

Get Started with Estate Planning

Varying degrees of estate planning can be implemented into your financial plan. The best place to start is talking through what is trying to be accomplished and giving yourself plenty of time to get all the proper legal documents in place and properly title assets. Please consult your estate planning attorney on any legal matters or contact Lutz Financial with any questions.

- Maximizer, Analytical, Futuristic, Relator, Strategic

Tom Hodgson, CFP®

Recent News & Insights

Electing Out of the Complex Variable Interest Entity (VIE) Guidance

What Your Business Needs To Know About Sales Tax

What are the Pros and Cons of Filing a Business Tax Extension?

How to Increase the Value of Your Business

%20(1)-Jan-02-2024-09-05-00-8712-PM.jpg?width=300&height=175&name=Untitled%20design%20(2)%20(1)-Jan-02-2024-09-05-00-8712-PM.jpg)

%20(1)-Mar-08-2024-09-22-41-1011-PM.jpg?width=300&height=175&name=Untitled%20design%20(5)%20(1)-Mar-08-2024-09-22-41-1011-PM.jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1)-Mar-08-2024-09-18-53-4361-PM.jpg?width=300&height=175&name=Untitled%20design%20(4)%20(1)-Mar-08-2024-09-18-53-4361-PM.jpg)

-Mar-08-2024-09-03-21-1119-PM.jpg?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-09-03-21-1119-PM.jpg)

-2.png?width=264&height=160&name=Website%20Featured%20Content%20Images%20(1)-2.png)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)