One of the indisputable benefits of owning a private company is the ability to determine your compensation. Whether this comes in the form of salary, bonus, owner's perquisites or distributions, an owner is able to effectively set their income (within reason, the Internal Revenue Service has stipulated).

In the case of a pass-through entity, such as an S Corporation, after deducting all expenses, including salaries and wages, all of the business income/loss will flow to the owner’s tax returns to be taxed at the individual rather than entity level. This single level of taxation for a pass-through entity is a primary benefit in electing to be taxed as an S Corp rather than a C Corp, which faces both an entity and dividend tax.

If the owner of a pass-through entity elects to make distributions, so long as the distributions received by a shareholder do not exceed his/her basis, they will not be taxable. Therefore, many business owners elect to make distributions from the company on a periodic basis, often becoming reliant on these earnings as a primary income source.

Practically speaking, this indistinguishable reliance upon salary and distributions as equal forms of compensation is not unreasonable. So long as the money flows to the owner and taxes are paid on the earnings, the difference seems more akin to an accounting/tax issue than a misleading indifference. However, the lack of a distinguisher between the treatment of salary and distributions as compensation can have implications when the need for a valuation arises. To demonstrate this, see the following example:

Example: Valuation of Company XYZ

Company XYZ is an S Corporation engaged in the business of providing landscaping services. The company is owned and managed by three individuals. Recently, a third-party approached Company XYZ with a buy-out offer, which is dependent on the three owners/managers continuing to work for the company. The price included in the buy-out offer is $1,250,000. Management of Company XYZ retained a valuation advisory firm to determine the reasonableness of the third-party offer price.

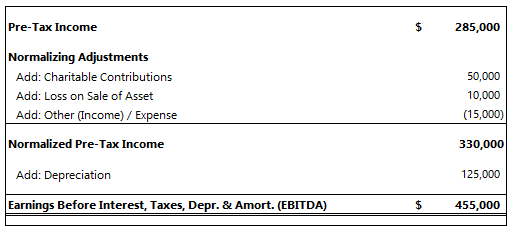

During the preliminary analysis stage, the valuation firm engaged by Company XYZ made three normalizing adjustments to the company’s pre-tax income to derive an adjusted EBITDA figure, as shown below.

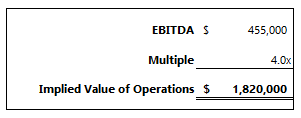

Applying a market-derived EBITDA multiple of 4x to the company’s adjusted EBITDA yields an implied value of company operations of $1,820,000. Based on the current fact set, the offer price of $1,250,000 seems to undervalue Company XYZ significantly.

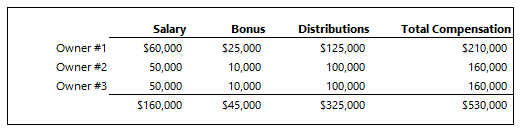

To better understand the operations of Company XYZ, the valuation firm requested information relating to the management compensation of the company. As stated earlier, the three owners of Company XYZ are also the three managers. When asked about their pay, the individuals stated that their take-home pay was competitive for the market. Owner #1, serving as the President of the company, earned $210,000 in 2018, while owners #2 and #3, both Vice Presidents, earned $160,000 each. Based on the valuation firm's research, this level of compensation is a fair indication of market compensation and what the owners could expect to receive, assuming they stayed with the company in their current management positions after the transaction.

However, red flags were raised by the valuation firm upon performing an independent analysis of the detailed compensation paid to the owners. While the owners were technically truthful in describing their level of earnings, both the substance and the form of the compensation must be considered. The following chart details the total compensation paid to the three owners/managers:

There are two main issues in play here.

1) The IRS may take issue with the level of salary and bonus paid to the owners. As demonstrated in various IRS cases (JD & Associates, Ltd. vs. United States of America [Case No. 3:04-cv-59]), a reasonable level of compensation must be paid to owners of pass-through entities. The basic thought process here is that even though the company's total business income will be taxed as earnings to each of the owner's personal tax returns, reasonable salaries must be taken to ensure the 15.3% of payroll taxes are collected based on total wages paid.

2) Assuming the owners expect to receive similar compensation after the transaction is completed, the cash flows of Company XYZ are overstated. The $325,000 of distributions paid out to managers in the prior year would now flow directly to the new owners after the transaction. Therefore, an adjustment must be made to appropriately reflect the miscategorized distributions paid to the owners as salaries and wages, as well as the associated payroll taxes, assessed at 15.3%.

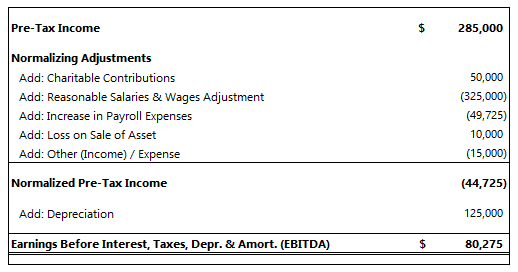

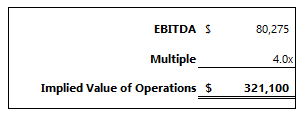

Adjusting the company's compensation levels to classify distributions received as salaries and wages appropriately greatly reduces the EBITDA of Company XYZ, as shown below.

Applying the same 4x multiple to the new adjusted EBITDA results in a diminished value of $321,100.

The above example demonstrates the impact that can occur with a simple adjustment made during the course of a valuation. While there was no ill-will by the owners in how they structured their compensation, the simple reclassification of distributions to salary and wages effectively eliminates the majority of the value of Company XYZ. It is best for both sides in a potential transaction to discover issues related to owner compensation before a large amount of resources are spent pursuing a deal destined to fall apart during the diligence phase. If you have any questions, please contact us.

Recent News & Insights

Financial Planning Advice for Recent College Grads

2024’s Hot Stocks Have Cooled Fast + 4.23.25

Do You Need a Family Office? 7 Aspects to Consider

Tariff Volatility + 4.7.25

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)