Net Working Capital Calculation Dilemma + Customer Deposits/Deferred Revenue

In a typical merger and acquisition transaction, determining the proper amount of net working capital to be in the business at the closing of a sale is one of the most important issues to navigate. It is normally assumed that the buyer will receive a certain amount of cash-free, debt-free working capital when they acquire the business called the net working capital (NWC) target. The standard components of NWC are accounts receivable plus inventory less accounts payable and accrued expenses. There can be other assets and liabilities that fall into NWC, and one that can be a challenge to deal with is deferred revenue/customer deposits.

Net Working Capital Calculation Issues

Advance Payments

Many businesses receive payments in advance from their customers for their goods and/or services. These are treated as current liabilities under financial reporting standards. In a transaction where a company has a material amount of these advances, the normal methods for determining a NWC target may not be appropriate.

The key issue is obvious, but it can get complex. The seller of a business (when selling assets) typically keeps the cash in the bank at closing. If that cash includes advance payments from customers, the buyer of the business will be responsible for providing the goods/services to the customer without the benefit of that cash! But if the deferred revenue has only been billed and not paid and is in accounts receivable, there is not an issue for the buyer.

Inventory and Accounts Payable

You must also take into consideration inventory and accounts payable. Was the advance payment made by the customer related to an item already held in inventory? If so, has the cost of the inventory been paid? Or is it part of the accounts payable being assumed by the buyer?

The Solution

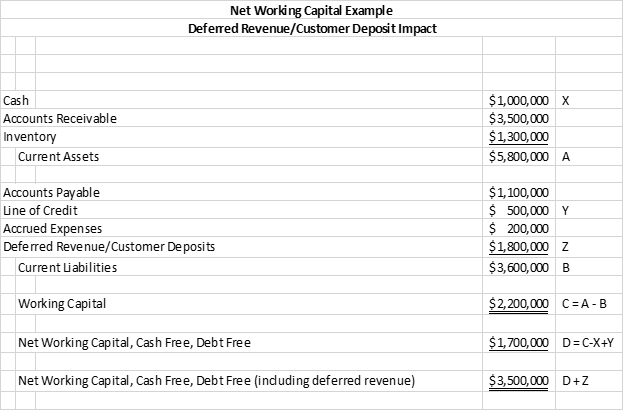

So how do you handle this problem? There is no textbook answer. You must negotiate through it unless there is an industry standard in place, which is rare for a lower-middle market business. The example below shows just how significant the deferred revenue can be in a NWC calculation.

The most logical way to settle this issue is to have the seller leave any cash received in advance from customers in the business and include the deferred revenue in the NWC calculation. Depending on the quality of the accounting information, determining that amount could be a challenge.

How Lutz M&A Can Help

Lutz M&A has assisted with variations of this scenario. We have seen transactions where the buyer did not make an adjustment to the NWC calculation where there was significant deferred revenue (gift card liability). We have also seen other transactions where the customer-advanced payments were treated as a reduction in the sale price. Either way, customer-advanced payments can have a material impact on a business sale transaction. Having an M&A advisor guide you through the negotiations is critical.

If you’d like to learn more about how Lutz M&A can help your business, please contact us. You can also read more on related topics by visiting our mergers and acquisitions blog.

- Activator, Achiever, Individualization, Analytical, Focus

Bill Kenedy

Bill Kenedy, Consulting & M&A Shareholder, began his career in 1990. He established Lutz's M&A practice in 2015 and has led its growth since then while serving on both the firm's board of directors and the Lutz Financial board.

Specializing in mergers and acquisitions, Bill guides business owners through critical transition decisions. He provides comprehensive exit planning and transaction services, with specialized expertise in the construction industry. Bill values helping owners achieve optimal outcomes by developing strategic solutions tailored to their unique situations.

At Lutz, Bill says it straight, offering candid guidance that helps owners make informed decisions about their businesses' futures. His direct approach to setting realistic expectations, combined with his focused drive to get deals done, has made him the go-to advisor for business transitions. As a Certified Exit Planning Advisor (CEPA), Certified Public Accountant (CPA), and Accredited Business Valuator (ABV), Bill brings technical expertise to every transaction. Under his leadership, the M&A practice has grown from a concept to a cornerstone of Lutz's service offerings.

Bill lives in Elkhorn, NE, with his wife, Angela. Outside the office, he spends time fishing, hunting, and following various sports teams.

Recent News & Insights

Finding a Lifelong Career

CMS Announces New Method II Billing Edits for Critical Access Hospitals

The Dollar and International Diversification + 4.30.25

Lutz Announces Ryan Cook as New Managing Shareholder

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)