Medicare Bad Debts + Recent Updates

There have been minimal changes to the regulations and manuals with respect to what is allowable, what should be, or what can be claimed for Medicare Bad Debts (MBD) on the Medicare Cost Report (MCR). Hospitals have experienced the reductions that started with fiscal years beginning on/after October 1, 2012. Providers have tried to keep up with the various versions they have had to implement over the years.

That long period of relative inattention to the regulations and manuals regarding the reporting and audit of bad debts has hit an abrupt halt. There was guidance via the IPPS 2021 Federal Register Final Rule to implement new procedures based on the type of MBD claimed.

In that Final Rule, CMS established three types of Medicare Bad Debt categories.

- Non-indigent beneficiary: A beneficiary who has not been determined to be categorically or medically indigent by a State Medicaid Agency to receive medical assistance from Medicaid and has not been determined to be indigent by the provider for Medicare Bad Debt purposes.

- Dual eligible beneficiary: A beneficiary who is enrolled in Medicare (Part A, Part B, or both) and “full Medicaid” and/or the Medicare Savings Program (MSP), including the Qualified Medicare Beneficiaries (QMB) program.

- Indigent by provider: A beneficiary who is non-dual eligible and has been determined to be indigent under the provider’s methods for determining indigency, using the evaluation criteria in the PRM §312 A through D.

To claim bad debts on the MCR, each category has specific processes and steps that must be taken to ensure that any bad debts claimed on the cost report will stand up to a CMS audit. Please pay particular attention to these procedural requirements.

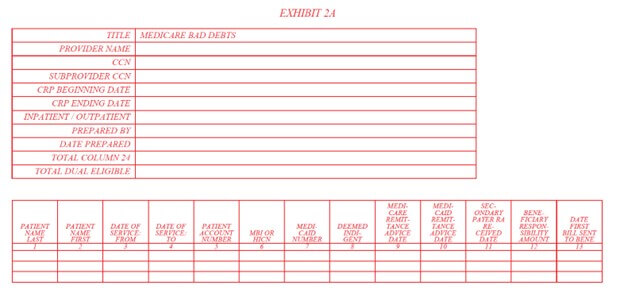

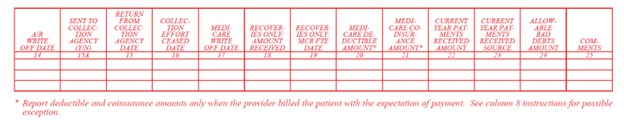

The cost report documentation requirements to claim Medicare bad debts have also been updated and are contained within the new Exhibit 2A for cost reporting periods beginning on/after October 1, 2022.

These additional processes and documentation requirements are not the end of CMS’ bad debt scrutiny. MACs have recently increased audit efforts with respect to bad debts claimed on the cost report, and this trend appears to be gaining momentum and intensity.

The OIG issued a report of findings from an audit of bad debts in December 2022, which indicated there are compliance issues in the reporting of bad debts on the Medicare cost report. The OIG recommended CMS consider issuing instructions and/or guidance to MACs that encourage additional audits and reviews of bad debts being claimed on cost reports. CMS agreed with the recommendation and subsequently implemented additional guidance to MACs for the review of bad debts. If you have any questions, please contact us, or learn more about our healthcare accounting and consulting services.

- Responsibility, Arranger, Includer, Harmony, Communication

Kirk Delperdang

Kirk Delperdang, Healthcare Director, began his career in 1993. With extensive experience in Medicare auditing and reimbursement management, he brings valuable regulatory insight to his role at Lutz.

Specializing in Medicare services for healthcare facilities, Kirk provides comprehensive guidance on enrollment, cost reporting, reimbursement analyses, and compliance matters. He focuses on delivering expert solutions to help community hospitals navigate complex Medicare requirements. Kirk values the opportunity to support healthcare organizations with the specialized knowledge they need to succeed.

At Lutz, Kirk's strong sense of responsibility and talent for arranging complex processes makes him an invaluable resource for clients. His methodical approach to Medicare compliance, combined with his clear communication style, helps facilities maintain proper enrollment while optimizing their reimbursement strategies.

Kirk lives in Omaha, NE, with his wife, Leslie. Outside the office, he enjoys spending time outdoors and with family.

Recent News & Insights

Financial Planning Advice for Recent College Grads

2024’s Hot Stocks Have Cooled Fast + 4.23.25

Do You Need a Family Office? 7 Aspects to Consider

Tariff Volatility + 4.7.25

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)