How to Choose the Right Entity Structure for Your Business

-Mar-27-2024-07-12-33-6725-PM.jpg)

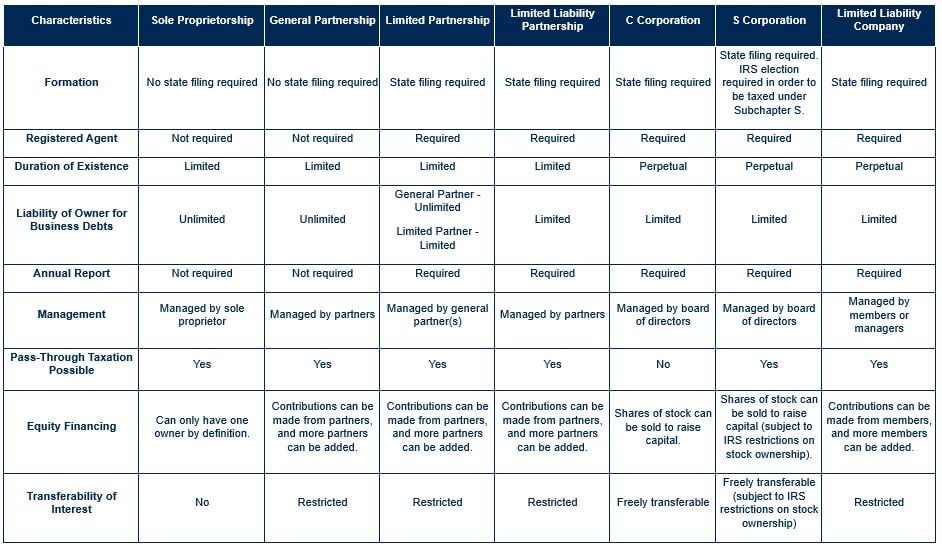

Embarking on a new business venture is exciting! One of the pivotal decisions you’ll make during this process is selecting a business structure. Choosing the right one is crucial as it can affect personal liability, taxation, management, and even your ability to attract investors. This blog will explore the different types of entities and their respective advantages, disadvantages, and tax considerations to help you make an informed decision that aligns with your objectives.

1. Sole Proprietorship: A Simple and Easy Option

In a sole proprietorship, the owner and the business are the same legally. This is the most basic and straightforward option. It suits small businesses such as freelancers, consultants, or independent contractors. This may be the best choice if personal liability is not a major concern and you value simplicity and control.

Advantages of Sole Proprietorship:

- Ease of Formation: Setting up a sole proprietorship is simple and does not require any formal registration or filing of documents. You can start operating under your name.

- Complete Control: As the sole owner, you have full control over the business and all decision-making.

- Simplified Taxes: Tax forms are relatively uncomplicated. Profits and losses are reported on your personal tax return on Schedule C, avoiding the need for separate corporate filings.

- Easy Dissolution: If you decide to close the business, liquidating assets is straightforward.

Disadvantages of Sole Proprietorship:

- Unlimited Personal Liability: The owner is personally liable for all business debts and legal obligations. This means that your assets, such as your home or car, can be at risk in case of a lawsuit or financial difficulty.

- Limited Access to Capital: Banks are often hesitant to provide business loans to sole proprietors, which may require you to rely on personal savings, home equity loans, or loans from family members.

- Lack of Continuity: The business ceases to exist upon the owner’s death. This can pose challenges if you intend for the business to continue after your passing.

2. Partnership: Sharing Responsibilities and Profits

Partnerships are a popular choice for businesses that involve multiple individuals who bring complementary skills and resources to the table and wish to share ownership and responsibilities. There are different types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships. It is important to carefully consider the potential for personal liability and the dynamics between partners before choosing this structure.

Advantages of Partnerships:

- Shared Responsibilities: Partnerships allow for the division of responsibilities and workload among multiple individuals. Each partner can bring unique skills and expertise to the business.

- Ease of Formation: Like sole proprietorships, partnerships are relatively simple to establish and do not require extensive legal formalities.

- Pass-Through Taxation: Partnerships are considered pass-through entities for tax purposes, meaning the partnership itself does not pay taxes. Instead, profits and losses are "passed through" to the partners, who report them on their personal tax returns.

- Continuity: Partnerships can continue to exist even if one partner leaves or passes away, provided the partnership agreement allows for it and two or more partners remain.

Disadvantages of Partnerships:

- Potential for Unlimited Personal Liability: In a general partnership, all partners have unlimited personal liability for the debts and obligations of the partnership. Each partner is jointly and individually liable for the actions of the other partners, which can put personal assets at risk. In a limited partnership, the general partner has unlimited liability for the debts and obligations of the partnership.

- Management Conflicts: Partners may not always agree on important decisions, which can lead to conflicts and challenges in managing the business.

- Profit Sharing Disputes: Dividing profits among partners can sometimes be a contentious issue, especially if partners feel they are not adequately compensated for their contributions.

- Limited Access to Capital: Similar to sole proprietorships, partnerships may face challenges in accessing external capital, as lenders may be hesitant to provide loans to partnerships.

- Self-Employment Taxes: Active partners could be subject to self-employment taxes on their share of the business profits, which may be a disadvantage for some individuals.

3. S Corporation: Tax Benefits and Shareholder Limitations

S corporations, also known as S corps, are a specific type of corporation that provides pass-through taxation while limiting personal liability for shareholders. To qualify as an S corp, the corporation must meet certain requirements.

Advantages of S Corporation:

- Pass-Through Taxation: Like partnerships, profits and losses are "passed through" to the shareholders, who report them on their personal tax returns.

- Limited Liability: Shareholders have limited personal liability for the debts and obligations of the corporation. Their assets are generally protected from business liabilities.

- Credibility and Perception: Operating as an S corporation can enhance the credibility and perception of the business with customers, suppliers, and investors. It may be seen as a more established and reputable entity than a sole proprietorship.

- Employee Benefits: Shareholders who are also employees may be able to take advantage of tax-deductible employee benefits such as health insurance, retirement plans, and education assistance.

Disadvantages of S Corporation:

- Shareholder Limitations: S corporations have restrictions on the number and type of shareholders they can have. They are limited to a maximum of 100 shareholders who must be U.S. citizens or residents.

- Formalities and Administrative Requirements: S corporations have more formalities and administrative requirements than sole proprietorships or partnerships. They must hold regular shareholder meetings, maintain corporate records, and comply with various legal and regulatory obligations.

- Potential for Taxation on Certain Profits: While S corporations offer pass-through taxation, certain profits may be subject to taxation at the corporate level. This includes certain types of passive income and built-in gains if the corporation was previously a C corporation.

- Limited Flexibility in Ownership: S corporations have restrictions on the types of shareholders they can have, limiting flexibility in ownership structure and potential future growth or restructuring opportunities.

4. C Corporation: Separating Ownership and Liability

Corporations are separate legal entities from their owners (shareholders). They offer the highest level of personal liability protection but also come with more complex legal and tax requirements. Corporations are suitable for larger or growth-oriented businesses that require access to significant capital, desire perpetual existence, and value the highest level of personal liability protection.

Advantages of Corporation:

- Limited Personal Liability: Shareholders' personal assets are generally protected from business debts and legal liabilities.

- Access to Capital: Corporations have more options for raising capital compared to other entity types. They can issue stock and attract investors, apply for business loans, and access additional sources of funding.

- Perpetual Existence: Unlike sole proprietorships and partnerships, corporations can continue to exist even if shareholders leave or pass away. They have a perpetual existence, which can provide stability and continuity for the business.

- Enhanced Credibility: Corporations often have a higher level of credibility and professionalism in the eyes of customers, lenders, and investors.

Disadvantages of Corporation:

- Complex Formation and Maintenance: Forming a corporation involves more complex legal processes and formalities than other business structures. It requires filing articles of incorporation with the state and complying with ongoing reporting and compliance requirements.

- Double Taxation: One significant disadvantage of a corporation is the potential for double taxation. Profits are subject to corporate income tax, and any dividends distributed to shareholders are taxed again at the individual level.

- More Regulatory Oversight: Corporations are subject to more regulatory oversight and scrutiny compared to other business entities. They must comply with various regulations, including holding annual meetings, maintaining corporate records, and electing a board of directors.

5. Limited Liability Company (LLC): Combining Liability Protection and Flexibility

Limited liability companies (LLCs) are a popular choice for businesses of various sizes and industries. An LLC offers the benefits of both a corporation and a partnership. It provides personal liability protection to its owners (referred to as members) while maintaining flexibility in management and taxation.

Advantages of LLC:

- Limited Liability Protection: Members’ personal assets are generally protected from business debts or legal liabilities.

- Flexible Taxation Options: LLCs have flexibility in choosing their tax treatment. By default, an LLC is taxed as a pass-through entity, similar to a partnership. However, LLCs also have the option to elect to be taxed as a corporation, either as an S corporation or a C corporation, depending on their specific needs and circumstances.

- No Ownership Restrictions: LLCs do not have restrictions on the number of members or the types of individuals or entities that can be owners unless the LLC elects to be taxed as an S Corporation.

- Simplified Record-Keeping: LLCs generally have fewer record-keeping requirements than corporations, making them easier to manage.

Disadvantages of LLC:

- Higher Formation and Maintenance Costs: Forming an LLC involves filing articles of organization with the state and paying associated fees. Additionally, there may be ongoing costs for maintaining the LLC, such as annual reports and other compliance requirements.

- State-Specific Regulations: Each state has its regulations and requirements for LLCs, which can add complexity, especially if you operate in multiple states.

- Self-Employment Taxes: If the LLC is taxed as a partnership, active LLC members could be subject to self-employment taxes on their share of the business profits, which may be a disadvantage for some individuals.

How Lutz’s Tax Services Can Help

Choosing the right business entity is a critical decision that has long-term implications for your business. Each type of entity offers its own advantages and disadvantages in terms of liability protection, tax considerations, ease of formation, and access to capital.

When deciding, consider the nature of your business, goals, and risk tolerance. It is advisable to consult with legal and tax professionals who can provide personalized guidance based on your specific circumstances. Lutz can provide you with the knowledge and resources to make the right decision. Please contact us with any questions.

- Analytical, Deliberative, Relator, Learner, Discipline

Adam Pfeiffer

Adam Pfeiffer, Tax Director, began his career in 2009. He has developed comprehensive expertise in tax planning and compliance, bringing extensive experience from both public accounting and industry roles. Adam leads internal tax education initiatives, helping develop the team’s technical skills.

Leveraging his experience in complex transactions, Adam focuses on providing tax consulting services to corporations, partnerships, and trusts. He specializes in helping clients navigate intricate tax implications during significant business transitions, particularly in mergers and acquisitions. Adam values delivering thorough analysis that supports clients' strategic decision-making processes.

At Lutz, Adam's analytical mindset and deliberative approach enable him to solve complex tax challenges effectively. His methodical evaluation of technical issues, combined with careful attention to detail, has established him as a leader in complicated tax transactions.

Adam lives in Omaha, NE, with his wife Tricia and their children, Ellinor and Levi. Outside the office, he golfs and follows the Huskers and the Cubs.

Recent News & Insights

Tired of Complex Books? 8 Ways to Simplify Your Accounting

HR Solutions That Elevate the Employee Experience

Cost Report Update

Multistate Tax Trends to Watch in the Midwest

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)