2021 Year in Review + Financial Market Update + 12.28.21

With only a handful of trading days left in December, I am amazed at how quickly time seems to fly by. This post will cap the second full year producing the Market Update, so I’d like to express my sincere gratitude to all the readers that have helped make it a success. As we prepare to enter 2022, I thought it would be worthwhile to pause and reflect on the major developments that shaped the markets in 2021.

Thanks again for reading, and Happy New Year!

Meme Stock Mania

In January, shares of companies including GameStop and AMC Entertainment exploded higher. The price of GameStop increased by over 1,700% in just over three weeks, while AMC soared more than 2,800% in the span of about 100 trading days. The phenomenon is attributed to a couple of different factors, though business fundamentals are not among them. General boredom, excess cash from stimulus checks, and a rapidly rebounding stock market lured scores of people into day trading. A popular Reddit forum geared toward the activity focused retail investor buying power into a few specific stocks, many of which were widely shorted by the hedge fund community. Although both AMC and GME are down about 55% from their 2021 highs, they are still considered widely overvalued. Speculative day-trading activity remains widespread.

Supply-Chain Bottlenecks

Challenges within the global supply chain have garnered significant attention this year. In early February, Ford announced it was reducing vehicle production because of its inability to source enough computer chips. Over the subsequent weeks, other major auto-producers joined in on the production cuts. Also, in February, a major winter storm slammed Texas, one of the world’s largest petrochemical producers used to create plastics, knocking significant production offline. In March, a massive container ship became stuck in the Suez Canal, one of the world’s busiest shipping arteries, for nearly a week. Finally, major US ports were unable to keep up with the rising level of imports from surging consumer demand. Container shipping rates may have peaked in early October, according to Drewery Supply Chain Advisors. But even after easing somewhat, shipping rates remain more than double what they were a year ago.

The Rise of Inflation

Inflation data published in April showed a considerable jump in the pace of price increases during March. The Core CPI, which strips out the volatile food and energy sectors, hit 3.0% YoY. This increase was to be expected; inflation had averaged a tepid 1.5% over the preceding year due to the initial lockdowns and subsequent restart of the economy. A normal rate of price increases was going to look elevated compared to the weak reading of the previous year (referred to as the base effect). Because of this and the expectation that supply-chain issues would quickly resolve themselves, must economists and policymakers expected elevated inflation readings to be ‘transitory.’ Fast forward to the end of the year, and the recently published November Core CPI figure came in at 5.0% YoY. Inflation has clearly been more persistent than people believed it would be earlier in the year. How the inflation story develops from here will be one of the most critical questions as we enter the new year.

Emergence of the Covid-19 Variants

In May, the CDC labeled Delta Covid-19 strain as a Variant of Concern (VOC). Believed to be twice as contagious and somewhat more severe than the original strain, Delta peaked in September. It is believed to have had a material impact on economic growth. Third-quarter GDP was just 2.3% (annualized), compared to 6.3% and 6.7% for the first and second quarters, respectively. More recently, the new Omicron strain became a VOC in November. The market had a sharp negative reaction to the announcement, as the high number of mutations within the new variant is believed to make existing vaccines less effective. Recent evidence suggests that while the new strain is even more contagious than Delta, the disease itself is less severe, particularly among those that have been vaccinated. The airline industry was forced to cancel thousands of flights over the holiday weekend as a spike of Covid infections left them understaffed during this busy period. It is unclear whether Omicron will have a significant impact on economic growth.

Waning Stimulus

Since the onset of the pandemic, economic growth has been supported by a significant degree of both fiscal and monetary stimulus. After the passage of the Infrastructure Investment and Jobs Act in November, it is unclear if any other major spending packages will be signed into law. Additionally, the recent policy pivot by the Federal Reserve suggests that monetary policy accommodation will be removed at an accelerated pace, with rate hikes poised to come sooner and more frequently.

Lockdown Stocks Become Losers

A large group of smaller high-growth stocks that delivered fantastic returns during 2020 have been under intense pressure in 2021. Companies like Peloton, Zoom, DraftKings, Chewy, and FuelCell Energy (the full list is comprised of dozens of stocks), which doubled, tripled, or even quadrupled in value last year, have declined anywhere from 40% to 75% this year.

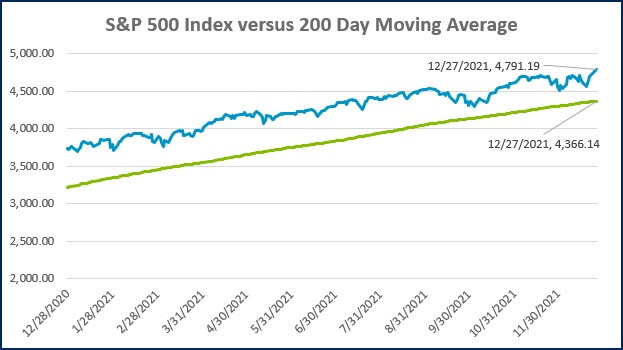

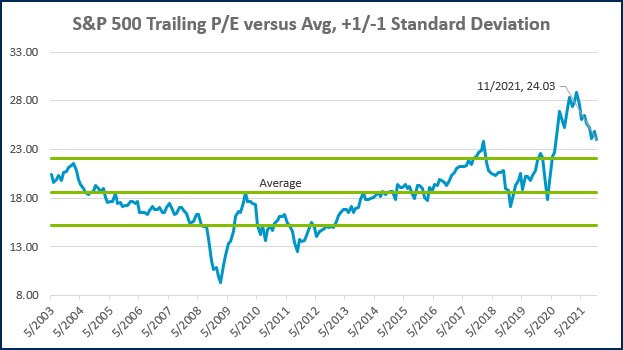

2021 Was a Great Year for the Market

Despite the myriad of challenges faced by the market in 2021, some of which were discussed above, stocks have had an excellent year thus far. There are still three full trading days left in the year, but as of early Tuesday, the S&P 500 is up just over 29% YTD. This puts the index on pace for its 3rd best annual return going back to 2000 (trailing only 2013 and 2019). With stretched valuations in parts of the market and the prospect of tighter monetary policy, investors should temper their expectations for returns in 2022.

WEEK IN REVIEW

- Data published last week showed that orders for durable goods, those made to last at least three years, increased 2.5% in November compared to expectations of a 1.5% gain. Shipments of non-defense capital goods (excluding aircraft), an important metric for the calculation of GDP, increased at a healthy 0.3% in November.

- Data published today showed the S&P CoreLogic Case-Shiller National Home Price Index climbed 19.1% in October from a year ago. While that figure obviously represents strong appreciation in the housing market, it marks the second consecutive month that the pace of home price gains has slowed.

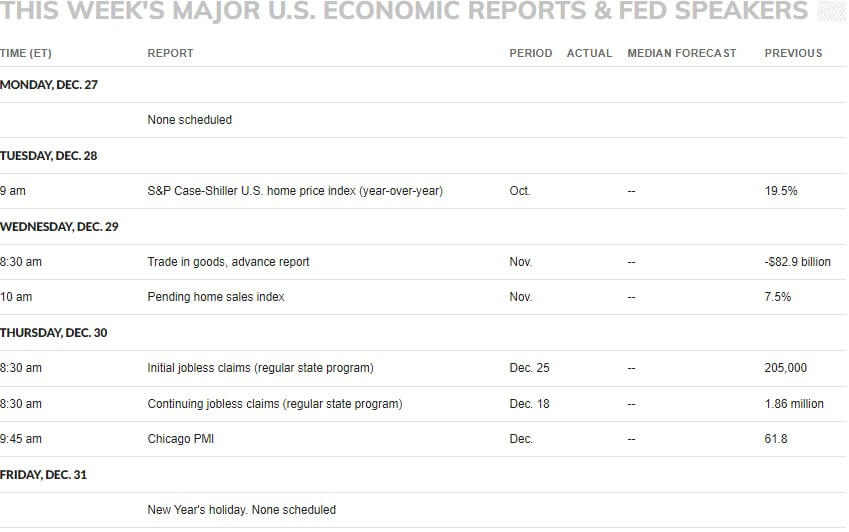

- The last week of the year will be light on new data releases. Thursday’s jobless claims data will headline the remainder of the week.

HOT READS

Markets

- Stock Pickers Are Struggling to Beat the Market (WSJ)

- U.S. Home Prices Surge 18.4% in October (CNBC)

- In Hot Job Market, Sarlires Start to Swell for White-Collar Workers (WSJ)

Investing

- 50 Laws of Investing (Evidence Investor)

- My 33 Investment Years (Rekenthaler Report)

- Bill Hwang of Archegos Capital Lost $20 billion in Two Days (Bloomberg)

Other

- What Near-Death Experiences Reveal About the Brain (Scientific American)

- Nebraska Omicron Cluster Suggests Faster Symptom Onset Compared to Past Covid Variants (CNBC)

- The Future of the Movie Industry (Ben Carlson)

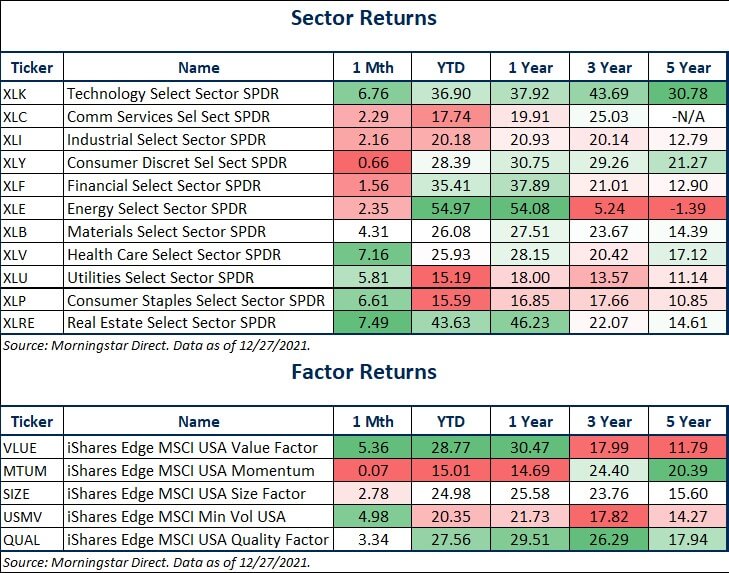

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

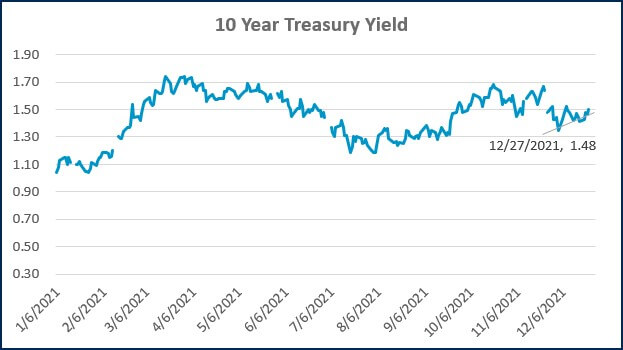

Source: Treasury.gov

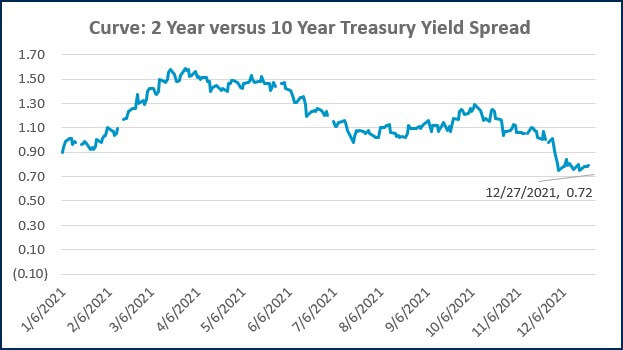

Source: Treasury.gov

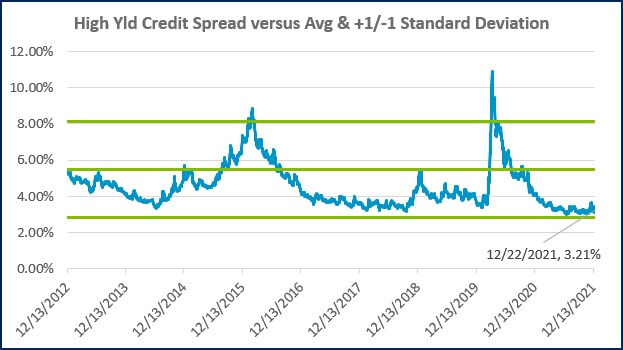

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

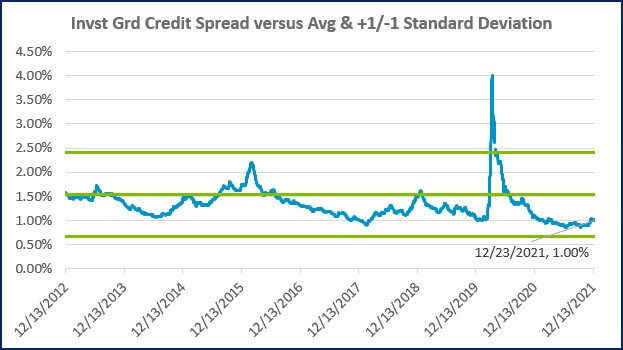

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

ECONOMIC CALENDAR

Source: MarketWatch

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Josh Jenkins, Chief Investment Officer, began his career in 2010. With a background in investment analysis and portfolio management from his previous roles, he quickly advanced to his current leadership position. As a member of the Lutz Financial Board and Chair of the Investment Committee, he guides Lutz Financial’s investment strategy and helps to manage day-to-day operations.

Leading the investment team, Josh directs research initiatives, while overseeing asset allocation, fund selection, portfolio management, and trading. He authors the weekly Financial Market Update, providing clients with timely insights on market conditions and economic trends. Josh values the analytical nature of his work and the opportunity to collaborate with talented colleagues while continuously expanding his knowledge of the financial markets.

At Lutz, Josh exemplifies the firm’s commitment to maintaining discipline and helping clients navigate market uncertainties with confidence. While staying true to the systematic investment process, he works to keep clients' long-term financial goals at the center of his decision-making.

Josh lives in Omaha, NE. Outside the office, he likes to stay active, travel, and play golf.

Recent News & Insights

Financial Planning Advice for Recent College Grads

2024’s Hot Stocks Have Cooled Fast + 4.23.25

Do You Need a Family Office? 7 Aspects to Consider

Tariff Volatility + 4.7.25

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)