Cash Is Not Trash + Financial Market Update + 10.3.23

In 2020, billionaire investor Ray Dalio famously claimed that “cash is trash,” which at the time was paying virtually 0% interest in bank deposits and money funds. Banks were charging fees to hold client cash and paying 0% interest, thus making cash a negative returning instrument. As recently as 2021, Treasury bills were trading close to or at 0%. Some days, those bills were even trading with negative rates, depending on the term.

What a difference two years make! Today, with the help of the Federal Reserve, interest rates have risen to their highest levels in more than 20 years on the short end. Money market funds and bank deposits have risen above 5%, so savers are now being rewarded for their cash with higher interest. Cash is not “trash” anymore as yields have risen dramatically.

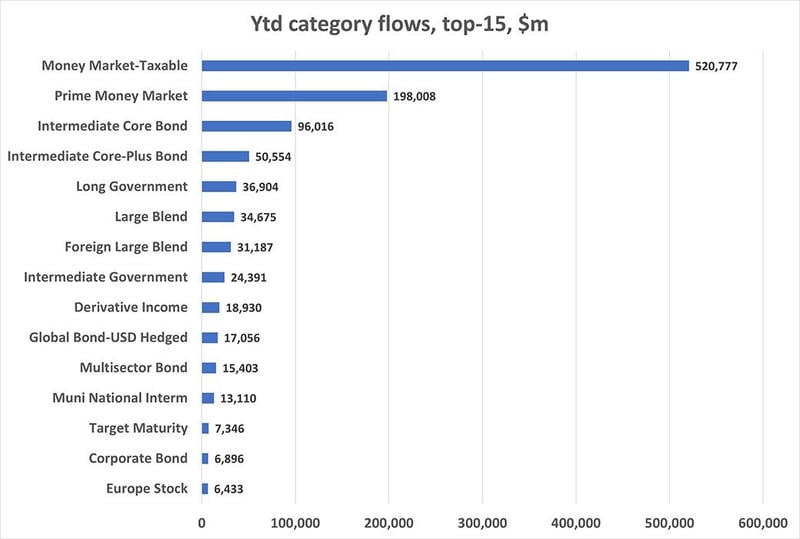

As you can see in the chart below, investors have poured more than $700 billion into money market funds during 2023 to earn these higher rates of interest. This is far greater than any other bond category by a large amount.

Source: Citywire RIA

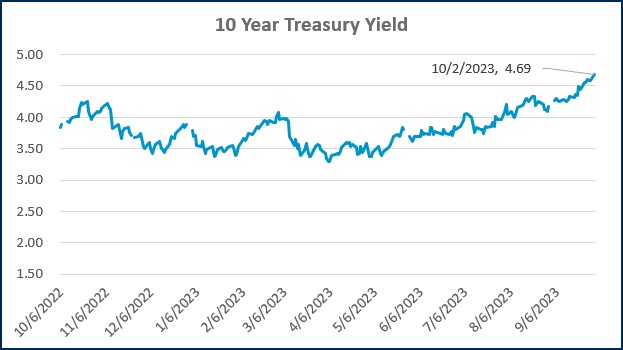

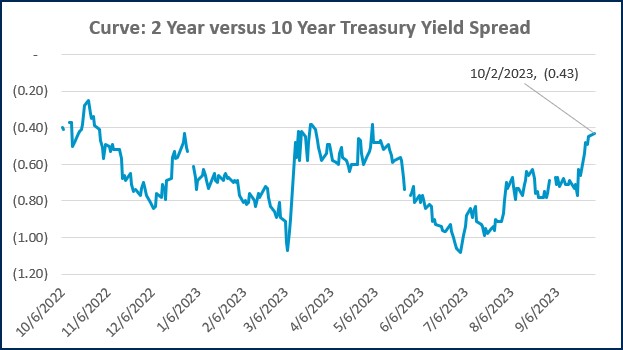

What makes it even more tempting to move more funds to cash is the fact that longer interest rates are slightly lower than short-term interest rates. For example, the 1-year Treasury bill is currently trading at 5.5%, and the 10-year Treasury note is trading at 4.75% at the time of this writing (10/3/2023). At first glance, a comparison of these two investments seems like a no-brainer. For the same credit risk (U.S. Government), I can get a higher yield and get my money back faster.

However, there is a hidden risk that you cannot see at face value. That is the re-investment risk that will occur after one year (and subsequent years). If your time horizon on the money is one year, you absolutely should be in shorter instruments such as the 1-year t-bill or money market funds. However, if you are like most investors, your time horizon is much longer than that.

With a purchase of a 10-year note at 4.75%, you are giving up yield today, but you are guaranteeing cash flows of 4.75% for ten years. On a $100,000 investment, simple math would say you would earn roughly $47,500 in interest throughout that 10-year investment at 4.75% (ignoring re-investment of interest). Conversely, if t-bills revert to a more normalized 3% interest rate over the nine years remaining after the first 5.5% t-bill matures, you would earn only $32,500. This is more than 30% less interest earned over the course of ten years.

Why would 3% be a more normalized interest rate for shorter-Treasury instruments? It’s because the Fed does not want to hold rates this high for extended periods of time. Normally, short-term rates trade at, or around, inflation rates (especially short-Treasuries). Holding interest rates higher hurts longer-term investment and the housing market, stresses banks, and causes higher interest costs for the government. It creates a higher return, less risky investment alternative. By the inflows to money markets in the chart above, you can see the movement of funds to the detriment of other asset classes. The Fed doesn’t want to hold higher any more than they have to as it jeopardizes long-term economic expansion.

Now, this is not to say that you should go out and invest in all 10-year notes if you have a longer investment horizon! Without a crystal ball, you must balance your portfolio for the long term. Sure, you need to hold shorter-cash-like instruments for the day-to-day. Savers and investors should appreciate the fact we are earning more on those funds at the moment. However, with longer time horizons, one must balance the urge to take the easy way and go to cash. It may work for today and even the next year or so, but could pose a problem later in the future when the environment for re-investment inevitably changes.

Week in Review

- On Monday, the ISM released its September Manufacturing PMI data, an indicator of economic health for the manufacturing sector. The data showed Manufacturing activity increased from 47.6 in August to 49.0 in September, the highest reading since November 2022. Manufacturing PMIs above 50 indicate expansion in manufacturing, while a number below 50 indicates contraction.

- Core PCE, the Fed’s preferred inflation indicator that excludes food and energy, rose .1% in August, lower than the forecasted .2% and the smallest monthly increase since November 2020. On a 12-month basis, Core PCE rose 3.9%, which was in line with forecasts. Headline PCE, which includes food and energy, rose .4% in August and 3.5% on a trailing 12-month basis.

- The dollar index, which tracks the dollar versus a basket of six foreign currencies, hit 107.34 on the morning of October 3rd, the highest level since November of 2022. The dollar’s recent strength can likely be attributed to surging treasury yields and softer inflation data, which increases the real rate of interest on U.S. Government debt.

Hot Reads

Markets

- The Fed’s Favorite Inflation Indicator Rose Less Than Expected In August (CNBC)

- Bank of Japan Hikes Bond Buying as Benchmark Yields Hit Decade Peak (CNBC)

- Americans Growing Reluctance to Quit Their Jobs, In Five Charts (WSJ)

Investing

- Weekend Reading: Don’t Care Permabears (Monevator)

- Three Things Investment People Hate to Admit (Ben Carlson)

- Can Economists Predict Recessions (St. Louis Fed)

Other

- Rise, Fall of Sam Bankman-Fried, FTX at Center of Michael Lewis’ New Book – 60 Minutes (YouTube)

- How Many Marvel Characters Were On Steroids (Vanity Fair)

- Kyle Berkshire Sets New Ball Speed World Record. Spoiler Alert: It’s Fast (Golf Digest)

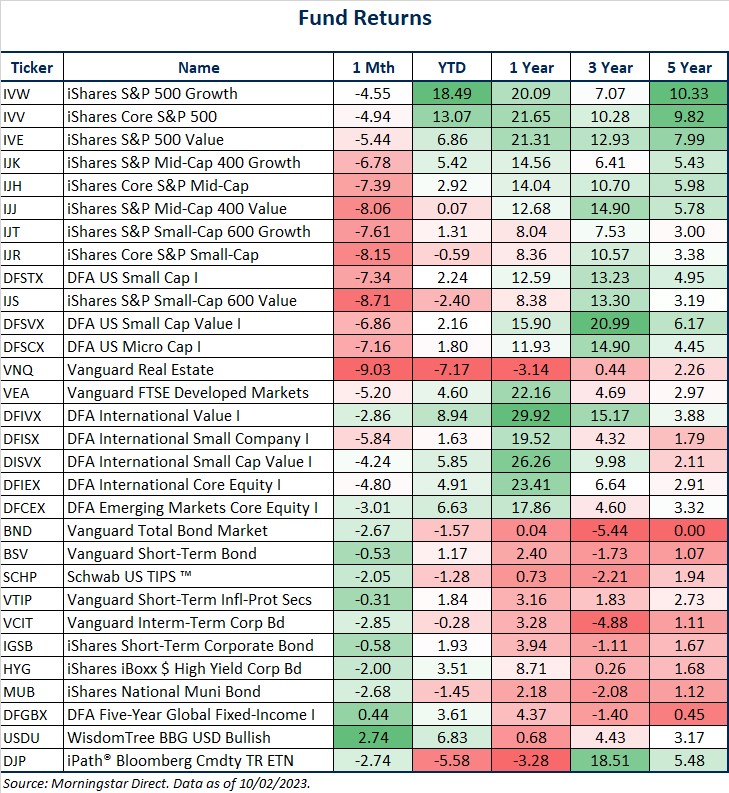

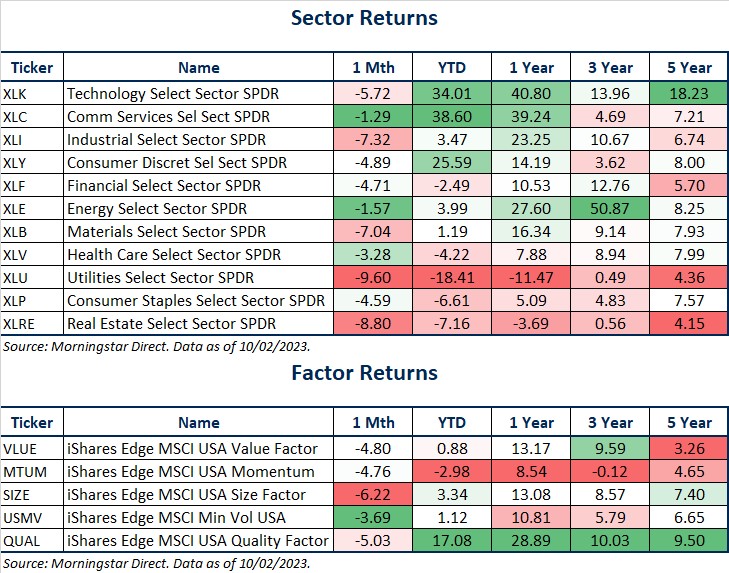

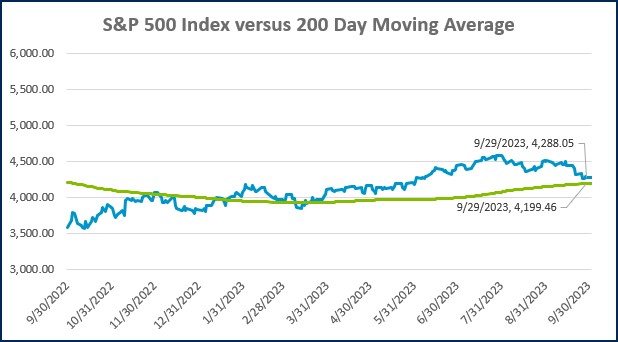

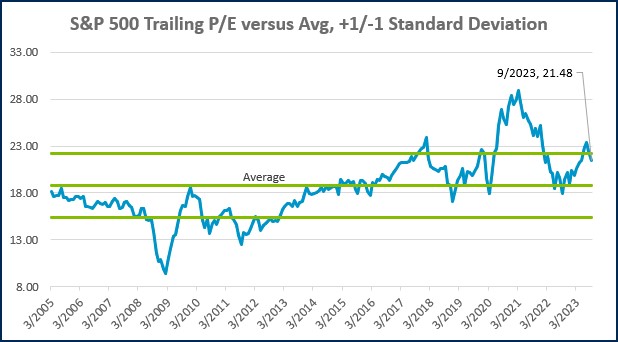

Markets at a Glance

Source: Morningstar Direct.

Source: Morningstar Direct.

Source: Treasury.gov

Source: Treasury.gov

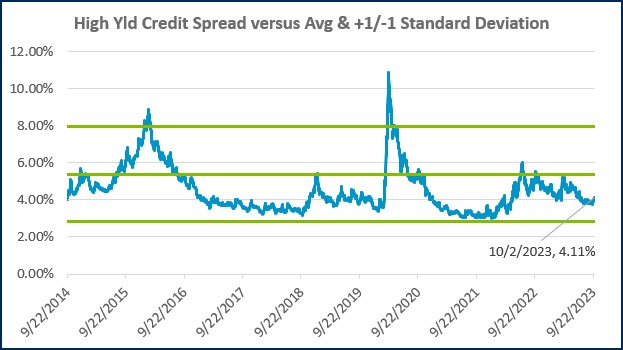

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

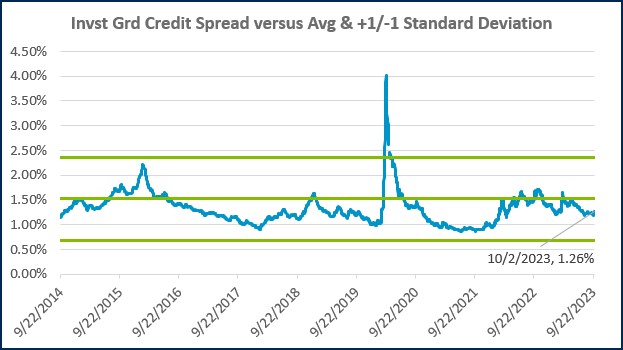

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

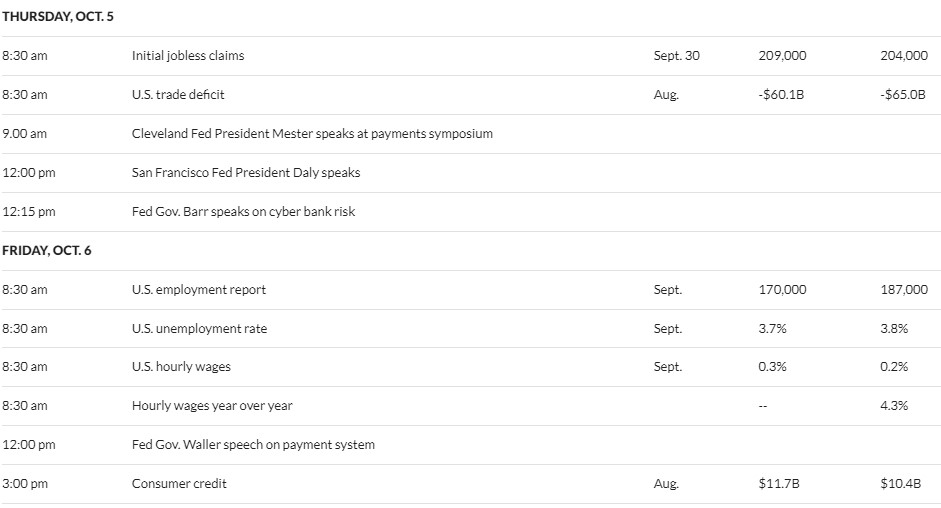

Economic Calendar

Source: MarketWatch

- Analytical, Strategic, Consistency, Includer, Input

Justin Vossen, CFP®

Justin Vossen, Investment Advisor and Principal, began his career in 1997. With extensive experience in finance, banking, and investment management, he brings comprehensive expertise to his role advising high-net-worth clients and foundations. As a member of the Lutz Financial Board his leadership extends beyond client relationships to shaping the firm's direction.

Leveraging his background in bond trading and portfolio management, Justin focuses on providing comprehensive investment and planning services. He develops tailored financial strategies across wealth management, retirement planning, and estate planning. Justin values creating solutions that give clients peace of mind about their financial situations.

At Lutz, Justin establishes unshakeable trust through his analytical mindset and strategic approach to investment management. He takes time to understand what truly matters to each client—whether it's retiring early or successfully transferring a business—and then builds comprehensive financial strategies to help them get there.

Justin lives in Omaha, NE. Outside the office, he can be found spending time with his wife, Nicole, and their children, Max and Kate.

Recent News & Insights

Financial Planning Advice for Recent College Grads

2024’s Hot Stocks Have Cooled Fast + 4.23.25

Do You Need a Family Office? 7 Aspects to Consider

Tariff Volatility + 4.7.25

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)