Important Tax Changes and Cost of Living Adjustments for 2023 + Financial Market Update + 10.25.22

Josh Jenkins, CFA, Chief Investment Officer, Principal

October 25, 2022

The Internal Revenue Service and other government agencies have made several recent announcements regarding changes to many tax provisions, schedules, and other adjustments in recent weeks. Below we will provide a summary of the major changes that will affect everyone in some way. As always, it is best to consult your tax professional as to how they directly relate to you!

WEEK IN REVIEW

- Earnings season continues, with a substantial portion of the S&P 500 reporting third quarter results this week. To date, 20% of the S&P 500 has reported as of last Friday’s close. The earnings growth rate, blended between companies that have already reported with the estimates for those that have yet to report, is at 1.5% year-over-year. This is slightly below FactSet’s forecast of 2.8% at the start of earnings season, and would mark the slowest earnings growth since the third quarter of 2020.

- The S&P CoreLogic Case-Shiller National Home Price Index was published this week and it showed home prices fell nationally by 1.1% from July to August. This marks the second straightly monthly price decline, and the largest such decline since December 2011. The index was still 13.0% higher than its level one year ago. The housing market has been rapidly cooling in the face of rising mortgage rates, which are currently averaging around 7% nationally.

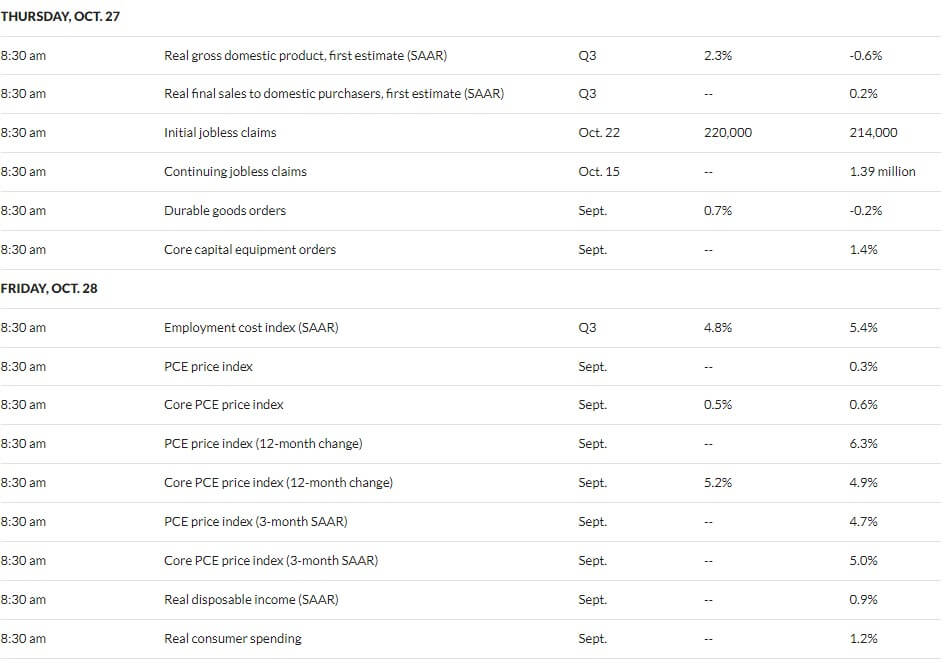

- Other notable economic data to be published this week includes consumer confidence, new home sales, durable goods orders, jobless claims (a proxy for layoffs), the initial estimate of Q3 GDP, the University of Michigan 5-year inflation expectations survey, and the Personal Consumption Expenditures (PCE) Index.

HOT READS

Markets

- Home Prices Cooled at a Record Pace in August, S&P Case-Shiller Says (CNBC)

- 3 Charts Showing The Market Turmoil Wreaked During UK PM Liz Truss’ Tenure (CNBC)

- Inflation is Dominating the Conversation on Earnings Calls. Here’s What Execs Are Saying (CNBC)

Investing

- Indexing Has Saved Investors $403 Billion Since 1996 (TEBI)

- Why Isn’t Inflation Falling? (Ben Carlson)

- Expectations and Reality (Morgan Housel)

Other

- What Have Workers Done With the Time Freed Up By Commuting Less? (Liberty Street Economics)

- Some People Really Are Mosquito Magnets, and They’re Stuck That Way (Scientific American)

- House of the Dragon Wants You to Trust Game of Thrones Again (Wired)

ECONOMIC CALENDAR

Source: MarketWatch

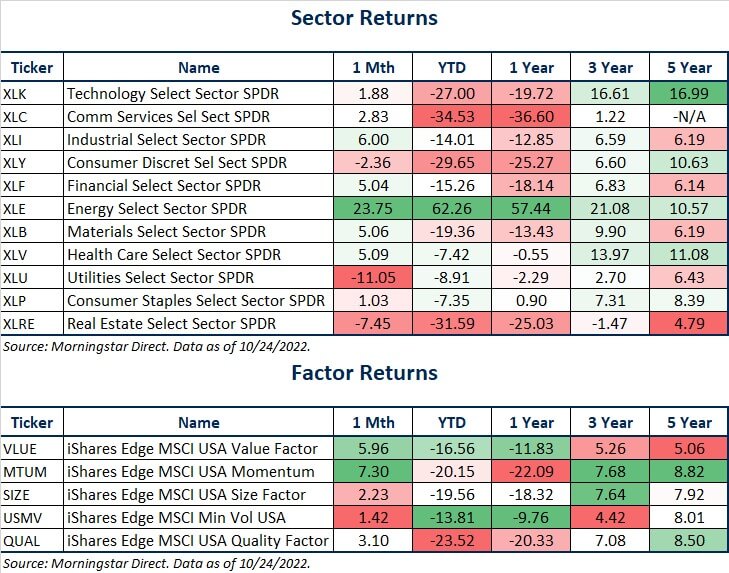

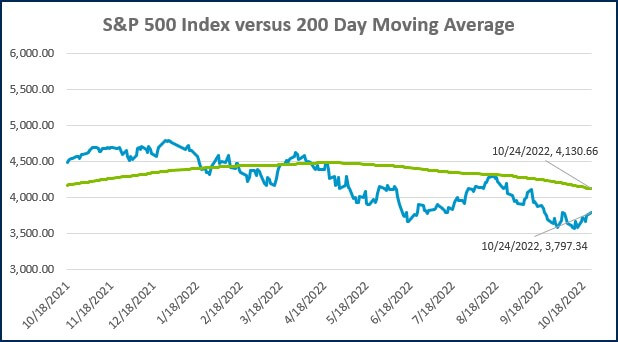

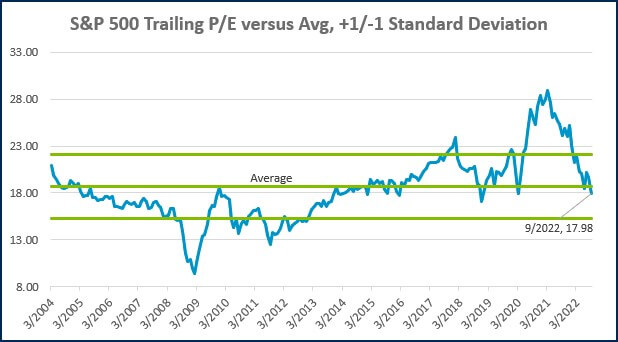

MARKETS AT A GLANCE

Source: Morningstar Direct.

Source: Morningstar Direct.

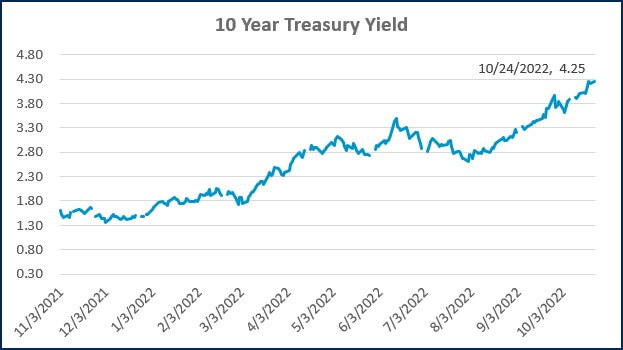

Source: Treasury.gov

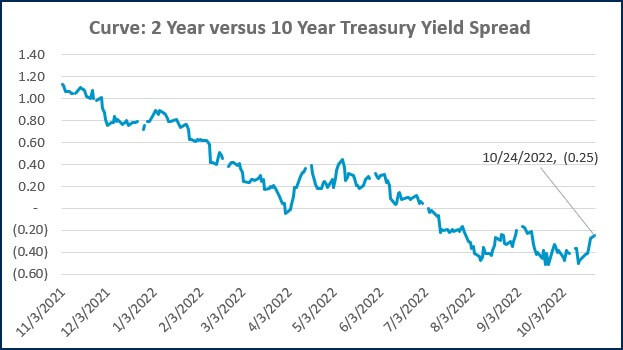

Source: Treasury.gov

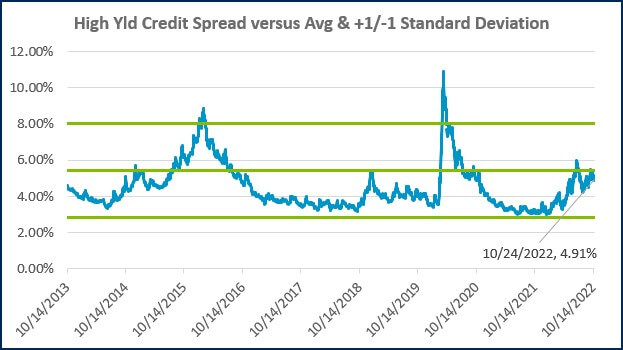

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

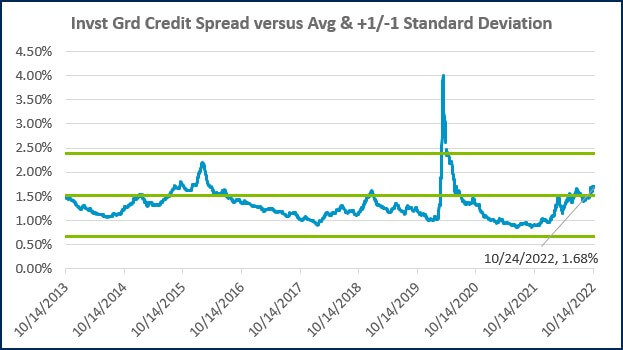

Source: FRED Database & ICE Benchmark Administration Limited (IBA)

- Competition, Achiever, Relator, Analytical, Ideation

Josh Jenkins, CFA

Chief Investment Officer, Principal

Josh Jenkins is a Chief Investment Officer and Principal at Lutz Financial. He began his career in 2010. Josh leads the Investment Committee and specializes in assisting clients with portfolio construction, asset allocation, and investment risk management. He is also responsible for portfolio trading, research and thought leadership, and the division's analytics and operational efficiency. He lives in Omaha, NE.

Recent News & Insights

Rural Hospital

Chargemaster Reminders & Common Issues

The complexity of healthcare billing demands careful attention to your facility's ...

Private Practice

Transition Planning for Retiring Physicians

Planning for retirement represents a pivotal moment in any physician's career. Beyond clinical ...

Market Commentary

Recent Volatility and Why We Diversify + 3.12.25

Over the last few weeks, a general feeling of anxiety has emerged within the stock market. ...

Private Practice

In-House vs Outsourced Controller for Medical Practices

Managing the financial health of your medical practice is no small feat. In fact, 92% of ...

Let’s get you where you want to go.

We work to simplify complexities, help make critical business decisions, and confidently focus on the things that are truly important to you. We embrace your business as our own to spark the right solutions and help you thrive.

%20(1)-Mar-08-2024-09-22-41-1011-PM.jpg?width=300&height=175&name=Untitled%20design%20(5)%20(1)-Mar-08-2024-09-22-41-1011-PM.jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1)-Mar-08-2024-09-18-53-4361-PM.jpg?width=300&height=175&name=Untitled%20design%20(4)%20(1)-Mar-08-2024-09-18-53-4361-PM.jpg)

-Mar-08-2024-09-03-21-1119-PM.jpg?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-09-03-21-1119-PM.jpg)

-2.png?width=264&height=160&name=Website%20Featured%20Content%20Images%20(1)-2.png)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)