Factors to Consider When Selling a C Corporation

.png)

What’s the difference between a stock sale and an asset sale, and why would a buyer or seller prefer one over the other? We’ll discuss the differences and highlight the tax issues affecting both buyers and sellers involved in C corporation merger and acquisition transactions. Additionally, we’ll go over the varying outcomes between these sales when your business is taxed as an S corporation instead of a C corporation and how that could potentially result in significant tax savings.

WHAT IS AN ASSET SALE?

An asset sale is the purchase of the seller’s assets and liabilities, but the seller retains possession of the legal entity. An asset transaction is implied when pricing a company using an EBITDA multiple (earnings before interest, taxes, depreciation, and amortization). These deals assume the buyer acquires the business on a “cash-free, debt-free” basis, meaning the seller keeps its bank account and pays off its bank debt, and the buyer ends up acquiring only the operating assets of the business. When selling a privately held business, in almost all circumstances, buyers expect the transaction to be structured as a purchase of assets.

WHAT IS A STOCK SALE?

A stock sale is the purchase of an owner’s shares of a corporation, thereby taking possession of the legal entity. Although selling a privately held business as a stock transaction is possible, it is not seen very often. The sale price is likely lower than what it would be under an asset sale transaction due to the fact the buyer loses out on some tax benefits that can be realized with a deal structured as an asset purchase.

WHY DO BUYERS OF A C CORPORATION PREFER AN ASSET SALE?

There are two primary reasons why buyers prefer acquiring business assets instead of stock.

TAX BENEFITS OF AN ASSET SALE

Buyers can deduct a portion of the sale price when a deal is structured as an asset purchase. Goodwill or other intangible assets acquired can be deducted over a 15‐year timeframe for tax purposes. Also, any equipment or other fixed assets acquired are typically valued at their fair market value and can be depreciated by the buyer.

In an acquisition of stock, the buyer does not get to deduct any of the goodwill or intangible assets, nor do they get to revalue the equipment and other fixed assets to fair market value and depreciate them. Buyers only get to depreciate the fixed assets at the seller’s remaining tax cost basis.

LEGAL LIABILITY CONCERNS

When assets are purchased, a new legal entity is set up, and any prior “sins” of the seller remain with the seller. But under a stock transaction, prior “sins” of the seller could be a problem for the buyer down the road.

Often, the legal liability issues can be dealt with through the attorneys drafting agreements and escrow of transaction proceeds. But the buyer typically addresses the tax benefit issue through the sale price itself, meaning a private company will receive less money from an acquirer for the sale of stock versus the sale of its assets.

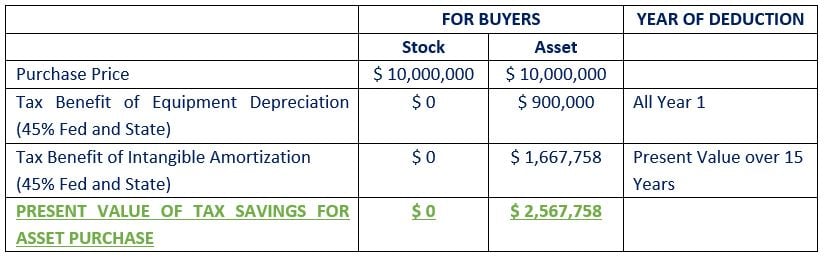

Example of the impact of a stock purchase vs. an asset purchase for a buyer of XYZ Corporation:

Facts:

Equipment Value ————————–$2,000,000 – Tax Deductible Year 1

Other Tangible Asset Value ————-$3,000,000 – Net Working Capital

Intangible Asset Value ——————- $5,000,000 – Tax Deductible Over 15 Years

Total Business Assets Value ————-$10,000,000

Assumption – Present Value Factor = 4%

MOST BUYERS EXPECT AN ASSET SALE

The fact of the matter is, in the world of lower‐middle market mergers and acquisitions, business sales are assumed to be sales of all operating assets of the business, not a sale of stock. Buyers assume this will be true and will receive the tax benefits (above) of the asset purchase. These tax savings help the buyer achieve the return on investment they expected when they priced the deal. If you are a C corporation and require the sale to be stock, not assets, buyers will not pay as much as they would with an asset sale because they will not receive any tax benefits, and their return on investment will be lower.

WHY DO SELLERS OF A C CORPORATION PREFER A STOCK SALE?

TAX IMPLICATIONS OF A STOCK SALE

For the seller, there are tax benefits when the deal is structured as a stock sale versus an asset sale. In a stock sale, a seller simply pays capital gains tax on their sale proceeds less whatever cost basis they have in the stock, regardless of whether the company is structured as a C corporation or an S corporation. But things get tricky when it comes to tax treatment in an asset sale.

TAX IMPLICATIONS OF AN ASSET SALE

For a C corporation, the sale of assets will create a taxable gain within the C corporation, and tax will have to be paid (note there is no capital gain rate for a C corporation, just one Federal corporate tax rate which is currently 21%). Then after the C corporation pays tax on the gain, the remaining amount is paid to the owners as a taxable dividend taxed at the capital gain rate (currently 20%). So, there are two levels of tax when selling assets of a C corporation. When you factor in state income taxes, the combined total tax when selling assets of a C corporation can exceed 50%.

As you can see, the issue is buyers of a C corporation want an asset sale for tax savings, but sellers of a C-Corporation want a stock sale to avoid double taxation. So, what can you do? An S corporation election may be the answer. Let’s consider the buyer-preferred asset sale from the perspective of an S corporation.

ASSET SALE FROM AN S CORPORATION PERSPECTIVE

Now for an S corporation, things are slightly different and, generally, better. The S corporation pays no tax on the gain from the sale of the assets. That gain is simply reported to the owners on a form K‐1, and the individual owners will pay tax on their share of the gain. An important note here is that any amount of the gain that relates to the sale of previously depreciated fixed assets will be taxed at the ordinary tax rate, NOT the capital gain rate. Depending on the type of business, that can be a significant factor in the amount of tax paid from the sale of assets in an S corporation. In almost all cases, the total tax paid from the sale of assets from an S corporation will be less than the sale of assets of a C corporation.

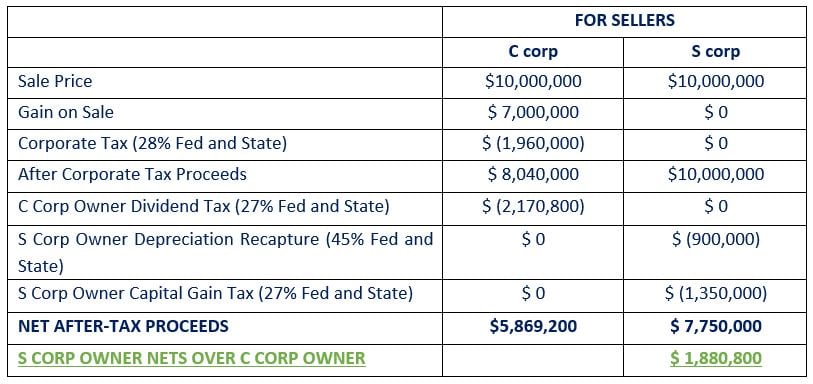

Example of the impact of an asset sale for a C corp vs. an S corp for a seller of XYZ Corporation

Facts:

Equipment Value ——————– $2,000,000 – Assume $0 Tax Basis

Other Tangible Asset Value ——- $3,000,000 – Assume $3,000,000 Tax Basis

Intangible Asset Value ————–$5,000,000 – Assume $0 Tax Basis

Total Business Assets Value ——-$10,000,000 (Less basis of $3m, resulting in $7m gain on sale)

Assumption – Present Value Factor = 4%

CONSIDER AN S CORPORATION ELECTION

The example above clearly shows S corporations come out far ahead of C corporations in the event of an asset sale. If you own a C corporation, and there is a chance that you will be selling the business to a third party in the future, you should be analyzing whether it makes sense for you to make an election to have your C corporation taxed as an S corporation.

Most business owners realize that someone other than them will someday own their business. It could be family members, employees, a third party, or a combination of the three. When a business transaction is set up to keep the business in the family, it is easy to structure the transaction as a stock sale/transfer. The same can be true (but not always) for a sale transaction to an employee, group of employees, or an ESOP. But when it comes to selling a business to a third party, it is much more challenging to get a deal structured as a sale of stock and even harder to get a buyer to pay the price they’d be willing to pay for assets for stock instead.

So, if you are a C corporation, you should really be asking yourself, “why?” Review what it would take to make an S corporation election. I have seen plenty of businesses taxed as C corporations that would not have any tax burden by converting to an S corporation. Although there can be benefits to being a C corporation, you should perform an analysis of those benefits versus the potential negative consequences in a sale scenario. Since there can be issues associated with making an S election depending upon certain factors within your C corporation, I suggest you review these annually with your CPA. The decision can be complex and needs to be well thought out. When deciding, the potential cost to you remaining a C corporation if you eventually sell the company to a third party should be one of the top considerations.

A few key points to note about the S election:

- You must make the election within 45 days of the year you wish to make the change.

- Income/losses from the business will flow through to the owners on an annual Form K-1. Each owner will have to pay individual income tax on their share of profits, including state income taxes, which can be burdensome if the company does business in a large number of states.

- There is a five-year waiting period before you officially become an S corporation when it comes to the sale of business assets. This means the double tax noted above exists for five years after making the S election.

- There could be a tax due by making the election (for cash basis taxpayers as well as a few other tax triggers). Keep in mind that S corporations can be cash basis.

- If your C corporation has accumulated Net Operating Losses, those are lost when you become an S corporation.

CONCLUSION

C corporation owners must ask themselves if it is truly beneficial to remain a C corporation. Is the annual tax savings on business income in a C corporation versus the higher individual rates worth it? Is the cost of making the S election high enough to justify remaining a C corporation?

Please contact us if you would like to discuss this further with a Lutz M&A and Lutz Tax professional.

- Activator, Achiever, Individualization, Analytical, Focus

Bill Kenedy

Bill Kenedy, Consulting & M&A Shareholder, began his career in 1990. He established Lutz's M&A practice in 2015 and has led its growth since then while serving on both the firm's board of directors and the Lutz Financial board.

Specializing in mergers and acquisitions, Bill guides business owners through critical transition decisions. He provides comprehensive exit planning and transaction services, with specialized expertise in the construction industry. Bill values helping owners achieve optimal outcomes by developing strategic solutions tailored to their unique situations.

At Lutz, Bill says it straight, offering candid guidance that helps owners make informed decisions about their businesses' futures. His direct approach to setting realistic expectations, combined with his focused drive to get deals done, has made him the go-to advisor for business transitions. As a Certified Exit Planning Advisor (CEPA), Certified Public Accountant (CPA), and Accredited Business Valuator (ABV), Bill brings technical expertise to every transaction. Under his leadership, the M&A practice has grown from a concept to a cornerstone of Lutz's service offerings.

Bill lives in Elkhorn, NE, with his wife, Angela. Outside the office, he spends time fishing, hunting, and following various sports teams.

Recent News & Insights

Understanding Farm Income Averaging

Job Counteroffers: What You Gain & What You Risk

Maximizing Your Nebraska R&D Credit

What do buyers look for when purchasing a roofing business?

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)