Advanced Estate Planning: What to Know Before 2026

The approaching deadline of January 1, 2026, is drawing closer, bearing significant implications for individuals and families regarding their estate. On this date, the current estate and gift tax exemptions are slated to revert to pre-2017 levels, necessitating a closer look at strategic planning. Presently, the exemption amount stands at a substantial $13.61 million per person ($13.99M for 2025). However, by 2026, this figure is expected to be halved, potentially settling closer to $7 million post-inflation adjustment.

While potential tax legislation may gain traction in 2025 with changes in Congressional control, the outcome is still uncertain. Early planning remains crucial.

Below is the full chart for the last 20+ years:

Portability, introduced in 2011, allows a surviving spouse to file a form and claim their deceased spouse’s unused estate exemption. For example, if John and Jane are married, and John never used his exemption before passing, Jane will be allowed to add John’s exemption amount to her own. So, instead of being left with only $13.61 million of exemption, Jane will have a $27.22 million exemption by claiming portability.

While the current estate and gift exemptions could be extended (or reduced) before sunsetting in 2026, this would require new legislation to pass Congress and get signed by the President. This is uncertain now and likely even more uncertain in the election year 2024.

What can be done prior to 2026?

If you want to protect the current exemption amount, you can utilize some or all of your current exemption by gifting assets before 2026. Gifts made before the sunset are grandfathered in even if the exemption amount drops in the future. However, the gift amount is important to the full usage of the exemption.

Example: John gifts $13,610,000 to an irrevocable trust in 2024, and in 2026, the federal estate exemption is reduced to approximately $7,000,000. The full amount of his 2024 gift remains outside of his personal (taxable) estate. However, it is worth noting that this only applies to amounts above the future exemption amount. If, in this same example, John had only decided to gift $6,000,000 and then the exemption amount dropped to $7,000,000, he would only have a $1,000,000 remaining exemption.

Strategic Estate Planning Opportunities

One Person Gifting vs. Gift Splitting

Married couples with two exemptions have options. For example:

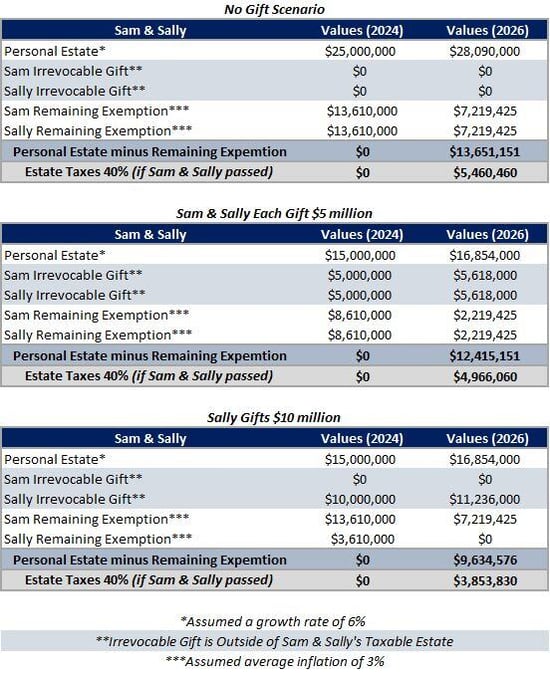

- Sam and Sally are married and have a net worth of $25 million.

- They have determined that based on their retirement goals, they can comfortably live on $15 million and view the remaining $10 million of their net worth as a legacy asset for their children and grandchildren.

- The chart below shows the estate tax impact of three scenarios: no gift today, each gifting $5 million today, or one spouse gifting $10 million today:

The key takeaway is that Sam & Sally would avoid the most estate tax if one person irrevocably gifted $10 million vs. each gifting $5 million into separate trusts. More variables would factor into the outcome, but this compares the benefit of one person using the exemption and splitting the gift.

Tax Basis

The tax basis of gifted assets is carried into the trust. If an asset had a $1 million unrealized gain before the gift, it keeps that $1 million unrealized gain inside the trust. One downside of making gifts to irrevocable trusts is the assets do not receive a step up in cost basis upon your passing, whereas assets in your taxable estate do (under current law). There are estate planning strategies that can be used to mitigate this, such as asset swapping.

Grantor Responsibilities

Under current law, grantor status would allow for payment of the trust taxes by the grantor. This is equivalent to allowing the grantor to make additional “gifts” to the irrevocable trust, as it will enable the trust to grow tax-free while the grantor continues to pay the trust tax bill. This is not considered a gift to the estate tax exemption limits, but it does continue to minimize the grantor’s personal estate. The grantor has a one-time option to change the taxes from being paid personally to being paid out of the trust. Once this is triggered, it can’t be undone. However, it may get to a point where the individual feels the trust is large enough to accomplish their estate planning goals, or taxes may get to a point where they are causing concern to the grantor’s personal financial picture. Many variables are worth factoring into the estate planning decision before determining the best fit for your situation.

Why now?

There is always the uncertainty of changes to the tax laws in the future. As recently as 2021, there were discussions to potentially lower the estate tax exemption to somewhere between $3.5 million and $5 million per person. A precedent has been established in the past that gifts already made would be exempt from reduced limits. Additionally, estate planning strategies take time to have the legal documents properly structured and put in place (including potentially retitling assets that are being gifted). As the 2026 sunset approaches, more people will likely have the same goals, which could further slow the process for everyone trying to accomplish these strategies.

We strongly recommend considering all options and limitations before putting anything in place. Please consult your estate planning attorney on any legal matters or contact Lutz Financial with any questions.

- Maximizer, Analytical, Futuristic, Relator, Strategic

Tom Hodgson, CFP®

Tom Hodgson, Investment Advisor, began his career in 2011. He has built extensive expertise in financial planning and wealth management while taking on leadership roles in training and estate planning initiatives.

Focusing on helping clients achieve their most important goals, Tom creates tailored financial strategies for everything from retirement preparation to education funding. He stays closely connected with clients' changing needs, regularly reviewing their investment portfolios and providing practical guidance. Tom finds fulfillment in helping clients who have worked hard in their businesses or professions feel confident about their financial future, whether they're saving for college, a wedding, or planning for retirement.

Tom lives in Elkhorn, NE, with his wife Carlie, their children Aubrey and Jack, and their dog Oakley. Outside the office, he can be found following the Jays and Huskers, cooking, golfing, and enjoying outdoor activities including hunting and fishing.

Recent News & Insights

Do You Need a Family Office? 7 Aspects to Consider

Tariff Volatility + 4.7.25

Lutz Named Top Consulting Firm in 2025 Omaha B2B Awards

Direct vs. Indirect Costs in the Construction Industry

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)