2020 + The Year of the Roth IRA Conversion

In 2016, I discussed whether Roth IRA conversions make sense for you as an investor (read here). A Roth IRA conversion is the process of moving funds from a Traditional IRA to a Roth IRA. In most instances, this triggers an ordinary income tax event in the year the conversion happens for the amount moved to the Roth IRA.

A 2010 tax law change brought accessibility of Roth IRA conversions to more investors by eliminating the income limit to effectuate a conversion- allowing a taxpayer to do so regardless of his or her earned income in a given year. A lot of the same premises I spoke about in 2016 still hold true today, and I will discuss why 2020 might be the ideal time to do a larger Roth IRA conversion.

Salary Reduction, Lower Income Due to Covid-19, Earlier Retirement, and the Retirement Income Gap

2020 has been nothing short of an unprecedented year in a multitude of ways. Over the past seven months, individuals and economies around the world have been wrestling with the COVID-19 pandemic. This once-in-a-century pandemic has wreaked havoc and disruption on many businesses and industries.

Here in the United States, we have experienced levels of unemployment not seen since the Great Depression. Individuals who were fortunate to stave off unemployment may have taken a sizable pay cut due to revenue loss, reduced salary, forced furlough, elimination of bonus, reduced sales commission, etc. Lower income, if only temporarily, lends itself to lower marginal income tax brackets and presents a great opportunity to accelerate income this year or next year at these lower brackets. Enter the Roth IRA conversion.

One of my favorite strategies for Roth IRA conversions with clients is to convert in what I call the “Retirement Income Gap.” This is the period after retirement but before receiving retirement income from sources like pensions, Social Security, and required minimum distributions (RMDs).

The COVID-19 pandemic has pushed some people into retirement earlier and accelerated the timeline for this retirement income gap. The traditional age for this income gap is taxpayers in their late 50s or early 60s who are retired but not taking Social Security retirement benefits or mandated to take RMDs (now age 72 as of 2020). Much like someone with reduced income in 2020, the concept is to accelerate income via a Roth IRA conversion at more favorable Federal tax rates (i.e. 12%, 22%, or 24%) while your taxable income is temporarily lower than it will be after age 72 or when you return to pre-pandemic income levels.

Tax Flexibility and Future Tax Rate Uncertainty

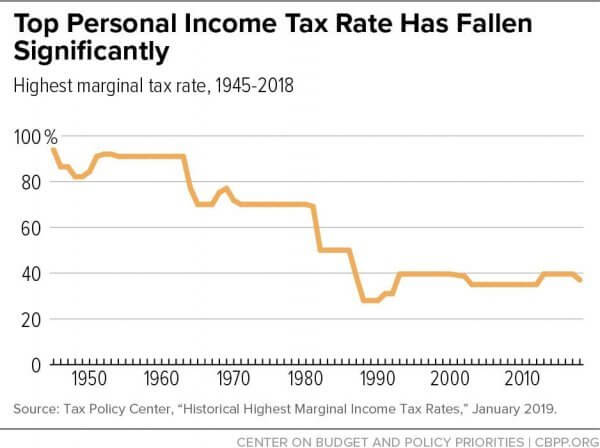

As I wrote in 2016, tax rate uncertainty is one of the biggest threats or unknowns to retirees who are in the distribution phase of drawing on a portfolio of assets to maintain a desired retirement lifestyle. The Tax Cuts and Jobs Act of 2017 further reduced marginal income tax rates across the board. The chart below from the Center on Budget and Policy Priorities shows the top marginal tax bracket every year post- World War II:

As you can see, we are in a period of historically low tax rates right now. These so-called Trump tax cuts are set to expire at the end of 2025. At that point, taxpayers in the marginal 12% Federal bracket will see tax rates move back to 2017 levels in which some of the income in the existing 12% bracket will more than double to 25%. This, of course, presumes there is no legislative change to extend these tax cuts further or the reverse, increase them before they sunset in 2025.

A Joe Biden presidential election and a Democratic Senate would likely mean proposals to eliminate the Trump tax cuts early and potentially even raise taxes across the board to above 2017 levels, especially for high-income earners. While this is mere speculation at this point, we believe tax rates will much likely be higher at some point in the future.

Having after-tax Roth IRA assets to call on protects investors from future tax rate increases over the course of a hopefully long retirement period. Many sources of retirement income (pensions, Social Security, dividends, rental income, etc.) are taxable as ordinary income and subject to the prevailing ordinary income tax rates at that given time. As such, I believe there is a lot of merit in doing a Roth IRA conversion now in a historically low tax rate environment to protect against future tax rate increases and get money in a tax-free growth bucket.

Downward Market Volatility

During the 1st Quarter of 2020, we saw the fastest 30% pullback in US market history. The S&P 500 ripped off around 35% of its value in a matter of five weeks. US small cap companies and value companies fared even worse during this pullback. The S&P 500 has seen a sharp rebound over the past four months led largely by the FAANGM and technology stocks to the point where it was virtually flat on the year after today’s trading session (7/28). Even though the S&P 500 has made it back to even for 2020, other slices and asset classes are still far off their all-time highs or even 12/31/2019 levels.

Prior to the Tax Cuts and Jobs Act of 2017, IRA recharacterizations or undoing a Roth IRA conversion was permitted until October of the following year. This would be done for several reasons- namely unexpected higher income that pushed a taxpayer into a higher tax bracket or large market declines after a Roth IRA conversion was done. The ability to recharacterize or unwind Roth IRA conversions would have been useful for those done in late 2019 due to the large market pullback earlier this year. The Tax Cuts and Jobs Act of 2017 effectively ended recharacterizations of Roth IRAs- making them permanent.

Since 2018 we have generally recommended waiting until late in the year (November or December) to get a clearer estimate of one’s income before doing any Roth IRA conversions. That thinking has somewhat been turned on its head in 2020 due to the big market pullback and equities being at depressed values. In fact, depending on the circumstances and situation we have recommended several larger conversions for clients in March and April that have worked out well thus far due to capturing much of the sharp rebound in the tax-free Roth IRA bucket. A market downturn or pullback could prove to be a great time to do a Roth IRA conversion because you are buying more shares of a fund or transferring more shares (if the conversion is in-kind or moving stocks or funds over without liquidating to cash first) at depressed values that now have a higher expected return going forward.

Spousal or Beneficiary Protection and RMD Planning

A final reason Roth IRA conversions might be a great fit in 2020 is another carryover from 2016. Roth IRA conversions today limit future RMDs from pre-tax retirement accounts. Many retirees have other sources of income in addition to RMDs, and it can create unwanted additional taxable income on top of Social Security, rental income, dividends/interest, capital gains, etc.

Upon turning age 72, the RMD amount is equal to roughly 4% of your IRA balance, with an increasing percentage every year thereafter as an individual’s life expectancy decreases. This may not be as significant for a married couple. However, widows are still subject to take RMDs of deceased spouses’ retirement accounts, and the income thresholds for single tax filers come much earlier than married joint filers.

If pre-tax IRAs are converted to Roth IRAs, it limits the amount of future RMDs and allows for the spousal protection of keeping assets in the Roth IRA to call on later when a widow is naturally in a higher tax bracket. There is the added benefit of no RMDs currently on Roth IRAs so they can remain in that tax-free bucket for a widow to cherry pick in a given year. Roth IRAs can also be passed onto children or future generations income-tax free, albeit they would then be subject to a mandated ten year drawdown period to liquidate the Roth after the IRA owner’s death.

As mentioned in my initial article, Roth IRA conversions can be a very useful tax planning tool for retirees. It offers tax flexibility in retirement and protection against future tax rate uncertainty or higher income levels for purposes of reducing future RMDs and spousal protection of single filer tax rates. 2020 is a perfect storm of sorts to do a larger Roth IRA conversion due to the disruption of income caused by the COVID-19 pandemic, historically low tax rates with a threat of legislative changes to increase marginal income tax rates, and the downward market volatility experienced so far this year. As with any tax recommendation, we encourage you to consult your CPA or tax advisor to see if and when a Roth IRA conversion makes sense for you.

- Achiever, Competition, Learner, Significance, Self-Assurance

Nick Hall, CFP®, CAP®

Nick Hall, Investment Advisor and Principal, began his career in 2010. Since joining Lutz in 2014, he has established himself as a key leader in the firm's wealth management and financial planning practice.

Focusing on business owners, professionals, and families with complex financial needs, Nick creates strategies tailored to each client's unique situation. He guides clients through investment decisions, retirement planning, and wealth transfer strategies, while helping them navigate tax considerations and charitable giving. What Nick values most is helping clients feel confident about their financial future and seeing them achieve their personal goals.

At Lutz, Nick serves beyond expectations for his clients, often thinking several steps ahead to address needs they haven't yet considered. His practical approach to complex financial challenges helps clients see a clear path forward, whether they're planning for business succession or managing family wealth across generations. By breaking down complicated concepts into actionable steps, he helps clients make confident decisions about their financial future.

Nick lives in Omaha, NE, with his wife Kiley and their three children, Amelia, Harrison, and Samuel. Outside the office, he enjoys spending time with family, watching sports, playing golf and softball, traveling, and exploring local restaurants.

Recent News & Insights

In-House vs. Outsourced Controller: What makes sense for my business?

Estate Planning Guide

Understanding Farm Income Averaging

Job Counteroffers: What You Gain & What You Risk

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)