2025 Process Overview

-

Client Resource Associates

These individuals will continue to aid 1040 clients and assist your Lutz Representative in keeping the tax process moving. They will notify you of information still needed to prepare your return. If you use Lutz for services outside of an individual 1040, you may also hear from them.

-

Reminder Communication

You will receive several updates via email, phone, and/or text regarding upcoming deadlines, outstanding information needed, and reminders to sign documents.

-

Engagement Letter

Lutz is transitioning to an annual engagement letter process for all accounting services. This update aligns with industry best practices and ensures we continue providing you with the highest level of service.WHAT TO EXPECT:-

You should have received an email from ThreadWorks requesting your electronic signature. Please sign as soon as possible.

-

Business clients may receive one email requesting one signature for all related business entities.

-

Individual and trust clients will receive separate emails to obtain a signature from each applicable party for each engagement.

- Engagement letters will outline current services. Any additional services throughout the year will fall under these terms. If the engagement letter you receive doesn’t cover other services you’ve engaged in, a separate, service-specific letter may follow.

- A copy of the engagement letter will be available in ThreadWorks to download for your records.

- To request a paper copy, please email clientresource@lutz.us.

-

-

Electronic Information Request

For individual clients, an Information Request is provided electronically via ThreadWorks. You should receive an email from notifications@thread.works in January that links to a list of initial items needed to prepare your tax return. If you cannot find this email, log in to ThreadWorks > Requests to locate the message. This is a live page, so you can continually upload documents as they become available. Additionally, you can provide documents via email to cra@lutz.us, mail, or front desk drop-off.

Please submit documents as soon as you receive them - no need to wait until you have everything. For 1040 clients, we must receive your information by March 15th. Otherwise, we cannot guarantee completion of your return by the April 15th deadline.

-

Electronic Portal Delivery

We will continue to use the ThreadWorks portal to deliver your tax returns electronically. Due to AICPA Independence Hosting Rules, you are responsible for downloading and retaining these items for your records.

-

Printed Documents

Tax forms that require immediate attention will be provided via paper (i.e., payment vouchers and paper-filed returns).

-

E-Signature

This will be used to electronically sign forms. If you haven't opted in already, email adminsupport@lutz.us to request e-sign invites when documents need to be signed. If filing jointly, both spouses will receive separate e-signature requests.

Upload Tax Documents

Important Deadlines

January 15th, 2025

– 4th Quarter 2024 Estimate Payments Due for Individuals

January 20th, 2025

– Annual Nebraska Sales Tax Filings Due

January 31st, 2025

– W2 and 1099 Filings Due

March 17th, 2025

– S Corporation and Partnership Returns Due

April 15th, 2025

– Individual, C Corporation, and Fiduciary Returns Due

– 1st Quarter 2025 Estimate Payments Due

May 1st, 2025

– Nebraska Personal Property Tax Returns Due

ThreadWorks FAQ

-

How do I create a ThreadWorks account?

- ThreadWorks accounts are created when your accounting professional shares files, requests information or sends an eSign request.

- Click the link in the email from notifications@thread.works. ThreadWorks will prompt you to register your account by providing a cell phone number and selecting a password.

-

How do I log in?

- Locate any email from notificaiton@thread.works and click on the link provided to be directed to the login screen.

- Log in here.

-

How can I reset my password or change my email address?

- Select the “Forgot Password” link on the ThreadWorks login page.

- Contact your Lutz Representative to request an update to your primary email address.

-

Why won't ThreadWorks load after I log in? Why does it say "Invalid User?"

- Confirm you are using the same email address for login as the one you received the notification.

- Contact your Lutz Representative or email support@lutz.us if you continue to have issues.

-

How do I send files securely to my accounting professional?

You can upload documents securely by using our secure document upload page.

-

How do I retrieve documents sent to me?

Click on the “Download Files” link in the email from notifications@thread.works. Log in to download the files. -

Where do I find the link to the information requested?

- Personal income tax return requests will be sent in January from notifications@thread.works to the primary email address on your account.

- For business clients, you will receive an information request email from notifications@thread.works to the primary email address on your account once we start your return if we have any missing items.

- Log in to ThreadWorks and select "Requests" from the portal home screen to view active requests.

-

Why is my info request blank?

New clients will not see prior year items in their request until we begin your return. Once you provide us with initial information, we will update your request with items we need. A generic request list may include:

- Prior Year Tax Return

- W-2’s

- Interest Income

- Dividend Income

- Capital Gains (1099-B)

- Business Income (Schedule C, Schedule E Rental, Schedule F Farm)

- K-1’s

- Mortgage Interest

- Real Estate Taxes

- Charitable Donations

-

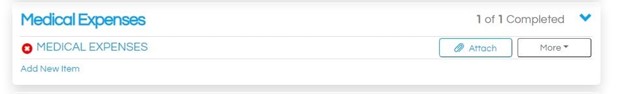

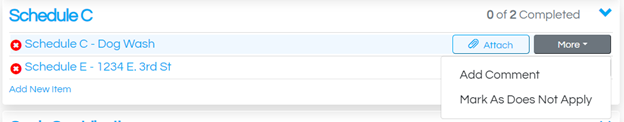

How do I use the information request page?

- To complete a form, select "Complete Form" next to the Tax Questionnaire item.

- To upload files securely, select "Attach" next to the item requested

- To add a comment or mark items as "Does Not Apply," select "More" next to the item requested.

-

Where can I find my 1099?

- Your custodian, such as TD Ameritrade, Schwab, Robinhood, etc. will provide you with a 1099-B in February.

- You should receive an email notification from your custodian that your tax documents are ready to be accessed. Please upload/attach your 1099 to the request.

- Didn’t receive a digital file? Please scan and upload your paper copy.

-

If Lutz prepares my K-1, do I still need to upload it?

If Lutz prepares your business return, we will mark off your K-1 on the info request when it is finished. You don’t need to provide us with a copy.

-

How can I notify you of my estimate payments?

- We need you to provide the dates and amounts paid for each estimate you made in 2024.

- Blank vouchers are not needed. We prefer copies of checks as support.

-

What are cash vs. non-cash donations?

- Cash Donations – Dollars you gave to a charitable organization.

- Non-Cash Donations – Items you gave to a charitable organization, such as clothing, stocks, cars, etc.

-

How do I notify Lutz that I have submitted my documents?

- Once you’ve added new information to the request, a ‘Submit for Review’ button will appear at the top and bottom of the page. Click the button to notify us when the information is ready for review.

- You don’t need to wait until you have everything in order to submit a first round of information to allow us to get started on your return.

- We will prompt you to submit additional items after we review your information and notify you of what is still missing.

-

Did you get my documents?

The request auto-saves, so any upload or comment you make we receive instantly. Clicking “submit for review” notifies us with a message but is not required to provide us with your information. -

How do I complete an e-sign request?

Click on the “Sign Documents Now” link in the email notification. New users will be asked to create a ThreadWorks account, while existing users will be asked to log in to sign the requested document.

-

How do I access a copy of a document I e-signed?

Login to your ThreadWorks account and click the E-sign icon. You should see items for which you have provided an e-signature for. Click on one of the items then "View PDF" on the right to view and download a copy for your records.

-

I cannot complete the security questions asked; what do I do?

Please contact your Lutz Representative for assistance. -

How will my tax return be delivered?

All tax returns are electronically delivered through your ThreadWorks portal. Due to AICPA Independence Hosting Rules, it is your responsibility to download and retain these items for your own records.

News & Insights

Lutz Named Top Consulting Firm in 2025 Omaha B2B Awards

Direct vs. Indirect Costs in the Construction Industry

Corporate Transparency Act: BOI Reporting Update

The CFO Outsourcing Option for Hospitals + Why it May Make Sense for You

%20(1)-Mar-08-2024-09-22-41-1011-PM.jpg?width=300&height=175&name=Untitled%20design%20(5)%20(1)-Mar-08-2024-09-22-41-1011-PM.jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1)-Mar-08-2024-09-18-53-4361-PM.jpg?width=300&height=175&name=Untitled%20design%20(4)%20(1)-Mar-08-2024-09-18-53-4361-PM.jpg)

-Mar-08-2024-09-03-21-1119-PM.jpg?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-09-03-21-1119-PM.jpg)

-2.png?width=264&height=160&name=Website%20Featured%20Content%20Images%20(1)-2.png)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)